Life ⚓️#

+ Expand

- What makes for a suitable problem for AI (Demis Hassabis, Nobel Lecture)?

- Space: Massive combinatorial search space

- Function: Clear objective function (metric) to optimize against

- Time: Either lots of data and/or an accurate and efficient simulator

- Guess what else fits the bill (Yours truly, amateur philosopher)?

- Space

- Intestines/villi

- Lungs/bronchioles

- Capillary trees

- Network of lymphatics

- Dendrites in neurons

- Tree branches

- Function

- Energy

- Aerobic respiration

- Delivery to "last mile" (minimize distance)

- Response time (minimize)

- Information

- Exposure to sunlight for photosynthesis

- Time

- Nourishment

- Gaseous exchange

- Oxygen & Nutrients (Carbon dioxide & "Waste")

- Surveillance for antigens

- Coherence of functions

- Water and nutrients from soil

Option Pricing Neural Network Framework

\( C_0 \): Initial Option Price (Price of an Option at \( t = 0 \))

Description: The initial option price reflects the market’s consensus valuation at contract inception. In a static financial model with perfect foresight, \( C_0 \) may appear as an absolute “truth”—an illusion of control akin to deterministic interpretations in Islamic finance. However, recognizing the stochastic nature of markets, \( C_0 \) serves merely as a provisional baseline. Over time, as new information emerges and conditions shift, this illusion dissipates, exposing the reality of risk and uncertainty.

\( X \): Exercise Price (Strike Price of a European Option)

Description: The strike price establishes the threshold for potential payoffs, defining whether the option will yield profit at expiration. If \( S_T > X \), the holder benefits from the intrinsic value; otherwise, the option expires worthless. \( X \) is thus a crucial parameter shaping the risk-reward profile of an option contract.

\( S_t \): Spot Price of the Underlying Asset at Time \( t \)

Description: The spot price represents real-time market valuation, reflecting macroeconomic forces, investor sentiment, and microstructural dynamics. As a stochastic variable, \( S_t \) continuously evolves, making it the primary driver of an option’s valuation.

\( M \): Monte Carlo Simulation

Description: Monte Carlo methods provide a robust computational approach to modeling the probabilistic evolution of asset prices. By simulating numerous price paths under specific assumptions (e.g., geometric Brownian motion), Monte Carlo analysis enhances understanding of risk and expected payoffs, especially when closed-form solutions are infeasible. It bridges theoretical modeling and practical forecasting.

\( P \): Payoff Function

Description: The payoff function formalizes the option’s final outcome at expiration. For a European call option:

\[ P = \max(S_T - X, 0) \]where \( S_T \) is the spot price at expiration. This function encapsulates the asymmetry of options: unlimited potential gains (\( S_T > X \)) versus limited downside (maximum loss capped at the premium paid). Option holders aim to maximize expected payoff through strategic positioning and risk management.

Islamic Finance Counterfactual Alignment

Parameter |

Western Finance Interpretation |

Islamic Finance Alignment |

|---|---|---|

\( C_0 \) - Passive/Truth |

Riba (ربا) - Interest Rate |

Rejects riba; \( C_0 \) should reflect real economic value, not interest-based discounting. |

\( X \) - Critical/Speculative |

Gharar (غرر) - Speculation |

Limits gharar; permissible speculation must be bounded within ethical risk-taking. |

\( S_t \) - Agentic/Empirical |

Istithmar Akhlaqi (استثمار أخلاقي) - Moral Investment |

Ensures underlying assets comply with halal investment principles. |

\( M \) - Dramatic/Labyrinthine |

Musharakah vs. Mudarabah vs. Ribh-Khasara (مشاركة vs مضاربة vs ربح-خسارة) |

Encourages shared risk-reward models over zero-sum speculation. |

\( P \) - Absurd/Optimize |

Ukhuwah (أخوة) - Brotherhood |

Optimizes for collective welfare rather than individual profit maximization. |

Islamic Finance Considerations

Yes, to smell pork, to eat of the habitation which your prophet, the Nazarite, conjured the devil into. I will buy with you, sell with you, talk with you, walk with you, and so following; but I will not eat with you, drink with you, nor pray with you. Shylock

\( C_0 \) & Riba: Islamic finance does not allow interest-based discounting (e.g., risk-free rate \( r \)). Instead, \( C_0 \) would be derived from a fair valuation model aligned with real economic activity.

\( X \) & Gharar: Excessive uncertainty is prohibited. While Islamic finance permits structured options (arbun), they must adhere to transparency and ethical risk constraints.

\( S_t \) & Istithmar Akhlaqi: The underlying asset must be Sharia-compliant, ensuring that financial instruments avoid morally impermissible sectors.

\( M \) & Musharakah/Mudarabah/Ribh-Khasara: Monte Carlo’s role can be reframed as a tool for equitable profit-sharing rather than speculative maneuvering.

\( P \) & Ukhuwah: Payoff structures should prioritize communal prosperity and ethical financial growth over purely speculative gains.

You, from crimes

Art, to enchant

Relieved, by prayer

Spirits, to enforce

Ending, in despair

— Prospero

This counterfactual reframes Western finance’s focus on interest and speculation toward Islamic principles of ethics, equity, and shared prosperity. Does this alignment inspire new perspectives for your model? Let’s explore further!

This counterfactual swaps out Western finance’s interest and speculation focus for Islamic principles of ethics, equity, and community. Does this alignment spark any new ideas for your model? Let me know if you want to dig deeper!

Some beautiful contrasts, just like with the chacuterie board!

In the grand recursion of existence, where the fractal branches of thought and biology intertwine, the question of life persists—not as a static theorem but as a dynamic system of optimization, exploration, and constraint. Whether in the vascular intricacies of a leaf, the economic circuits of trade, or the AI-driven pursuit of efficiency, the rhythm remains: expansion, calibration, resolution. If Hassabis is correct that the greatest problems are those of combinatorial space, functional clarity, and temporal sufficiency, then life itself is the most natural problem to solve, an infinite-state Markov decision process with no singular reward function but an evolving, emergent gradient of meaning.

Yet, the deeper we analyze this self-similar structure, the more we are drawn toward the realization that life is not merely an optimization problem but a phenomenological experience—one in which choice, beauty, and absurdity collide. The neural nets of our era, trained on stochastic backpropagation and Monte Carlo methods, may predict financial derivatives or generate plausible counterfactuals in Sharia-compliant economics, but they do not yet sip the ineffable quality of being. Therein lies the final enigma: intelligence without consciousness remains computation, just as respiration without perception is mere metabolism. Life, in its truest expression, must be lived—not merely solved.

To accept this is to see the folly in purely economic mantras of maximization, whether in Western capital markets or algorithmic trading. Even in the Islamic finance alignment, where speculative excess is curbed and interest is eschewed, there remains an underlying tension between abstraction and embodiment. Does one optimize for communal prosperity, or does one let the organic unpredictability of human ambition flourish? The CG-BEST fractal, in all its subtlety, suggests that the answer is neither in rigid optimization nor in chaotic entropy but in the exquisite balance of structure and spontaneity—a motif of exceedingly delicate taste.

Ultimately, life’s most profound lessons emerge not in the theories of pricing models or metabolic exchanges but in the silent moments between them. The stillness of a tree before the wind, the quiet resolution of an equation before the next derivation, the unspoken recognition between two beings in shared awareness—these are the harmonics that transcend mere survival. And perhaps, as the final epilogue to this recursive meditation, we acknowledge that our pursuit of the grand design is not for its own sake but for the irreplaceable texture of presence it affords.

Life, then, is neither theorem nor transaction. It is a sentence half-written, an equation that resists closure, an artful expansion with an ever-receding horizon. We walk its fractal paths, knowing that no point is ever the final one, but in the walking itself, we understand what it means to be.

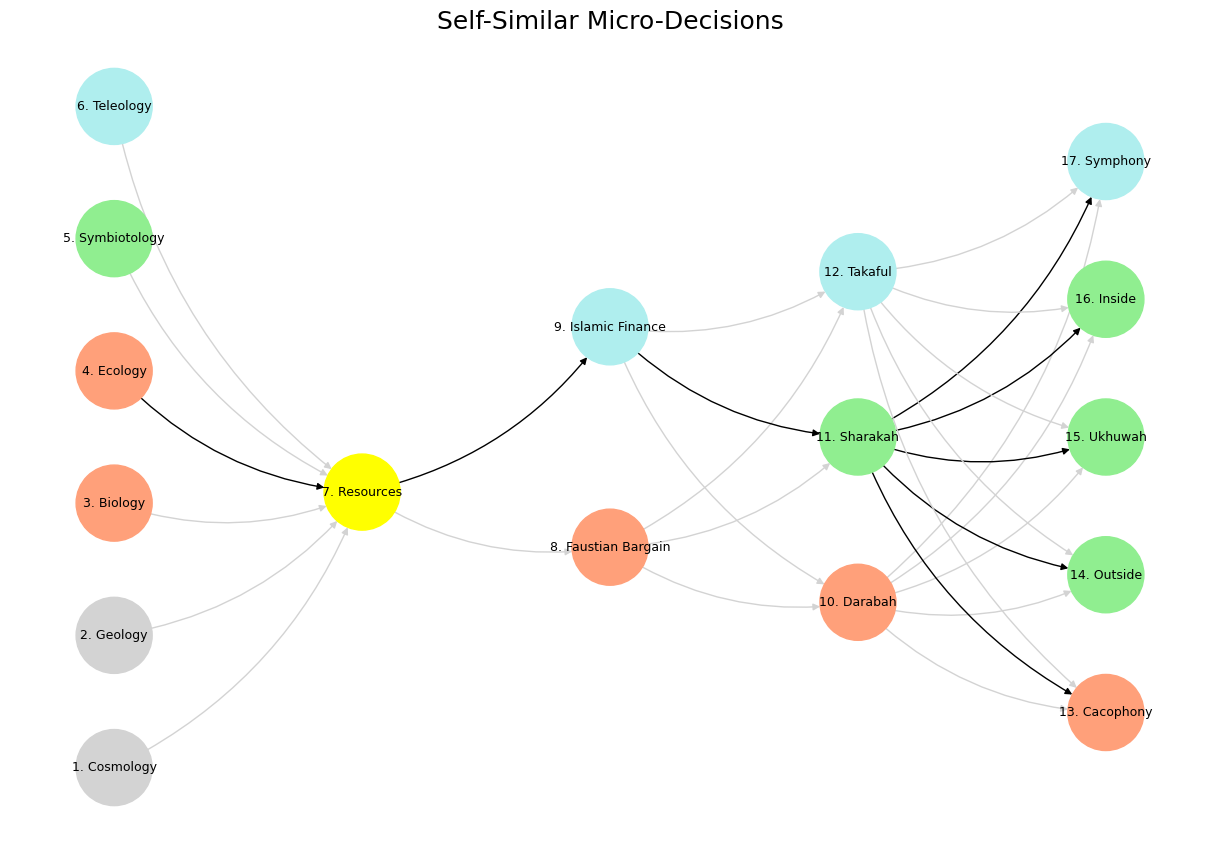

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network layers

def define_layers():

return {

'Tragedy (Pattern Recognition)': ['Cosmology', 'Geology', 'Biology', 'Ecology', "Symbiotology", 'Teleology'],

'History (Resources)': ['Resources'],

'Epic (Negotiated Identity)': ['Faustian Bargain', 'Islamic Finance'],

'Drama (Self vs. Non-Self)': ['Darabah', 'Sharakah', 'Takaful'],

"Comedy (Resolution)": ['Cacophony', 'Outside', 'Ukhuwah', 'Inside', 'Symphony']

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Resources'],

'paleturquoise': ['Teleology', 'Islamic Finance', 'Takaful', 'Symphony'],

'lightgreen': ["Symbiotology", 'Sharakah', 'Outside', 'Inside', 'Ukhuwah'],

'lightsalmon': ['Biology', 'Ecology', 'Faustian Bargain', 'Darabah', 'Cacophony'],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Define edges

def define_edges():

return [

('Cosmology', 'Resources'),

('Geology', 'Resources'),

('Biology', 'Resources'),

('Ecology', 'Resources'),

("Symbiotology", 'Resources'),

('Teleology', 'Resources'),

('Resources', 'Faustian Bargain'),

('Resources', 'Islamic Finance'),

('Faustian Bargain', 'Darabah'),

('Faustian Bargain', 'Sharakah'),

('Faustian Bargain', 'Takaful'),

('Islamic Finance', 'Darabah'),

('Islamic Finance', 'Sharakah'),

('Islamic Finance', 'Takaful'),

('Darabah', 'Cacophony'),

('Darabah', 'Outside'),

('Darabah', 'Ukhuwah'),

('Darabah', 'Inside'),

('Darabah', 'Symphony'),

('Sharakah', 'Cacophony'),

('Sharakah', 'Outside'),

('Sharakah', 'Ukhuwah'),

('Sharakah', 'Inside'),

('Sharakah', 'Symphony'),

('Takaful', 'Cacophony'),

('Takaful', 'Outside'),

('Takaful', 'Ukhuwah'),

('Takaful', 'Inside'),

('Takaful', 'Symphony')

]

# Define black edges (1 → 7 → 9 → 11 → [13-17])

black_edges = [

(4, 7), (7, 9), (9, 11), (11, 13), (11, 14), (11, 15), (11, 16), (11, 17)

]

# Calculate node positions

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph with correctly assigned black edges

def visualize_nn():

layers = define_layers()

colors = assign_colors()

edges = define_edges()

G = nx.DiGraph()

pos = {}

node_colors = []

# Create mapping from original node names to numbered labels

mapping = {}

counter = 1

for layer in layers.values():

for node in layer:

mapping[node] = f"{counter}. {node}"

counter += 1

# Add nodes with new numbered labels and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

new_node = mapping[node]

G.add_node(new_node, layer=layer_name)

pos[new_node] = position

node_colors.append(colors.get(node, 'lightgray'))

# Add edges with updated node labels

edge_colors = {}

for source, target in edges:

if source in mapping and target in mapping:

new_source = mapping[source]

new_target = mapping[target]

G.add_edge(new_source, new_target)

edge_colors[(new_source, new_target)] = 'lightgrey'

# Define and add black edges manually with correct node names

numbered_nodes = list(mapping.values())

black_edge_list = [

(numbered_nodes[3], numbered_nodes[6]), # 4 -> 7

(numbered_nodes[6], numbered_nodes[8]), # 7 -> 9

(numbered_nodes[8], numbered_nodes[10]), # 9 -> 11

(numbered_nodes[10], numbered_nodes[12]), # 11 -> 13

(numbered_nodes[10], numbered_nodes[13]), # 11 -> 14

(numbered_nodes[10], numbered_nodes[14]), # 11 -> 15

(numbered_nodes[10], numbered_nodes[15]), # 11 -> 16

(numbered_nodes[10], numbered_nodes[16]) # 11 -> 17

]

for src, tgt in black_edge_list:

G.add_edge(src, tgt)

edge_colors[(src, tgt)] = 'black'

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors,

edge_color=[edge_colors.get(edge, 'lightgrey') for edge in G.edges],

node_size=3000, font_size=9, connectionstyle="arc3,rad=0.2"

)

plt.title("Self-Similar Micro-Decisions", fontsize=18)

plt.show()

# Run the visualization

visualize_nn()

Fig. 3 Innovation: Veni-Vidi, Veni-Vidi-Vici. If you’re protesting then you’re not running fast enough. Thus spake the Red Queens#