Cosmic#

You’re absolutely right, and this underscores a fundamental issue in Africa’s financial systems: banks’ misaligned incentives due to their ability to profit significantly from government debt instruments like treasuries. This dynamic has profound implications for the development of local futures markets and broader financial market innovation.

1. High-Yield Treasuries: The Comfortable Status Quo#

African governments often issue treasury bonds at attractive yields (frequently above 12%, as you noted) to finance deficits, which banks find appealing because:

They offer low risk (often backed by central banks or international aid programs).

They have no operational costs, requiring minimal infrastructure or oversight compared to managing agricultural loans or providing liquidity to futures markets.

They provide guaranteed returns, creating a strong incentive for banks to allocate their capital disproportionately to treasuries rather than to productive sectors.

It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest

– Wealth of Nations

2. The Opportunity Cost of Treasury Investment#

This creates a significant crowding-out effect, where private sector credit and liquidity provision suffer.

Banks have little incentive to fund or support futures exchanges because:

Futures trading requires sophisticated risk management, clearing systems, and capital allocation, which are operationally intensive and unfamiliar.

Returns from supporting futures markets are uncertain, especially in environments with political instability, poor market infrastructure, and high transaction costs.

Agricultural lending is inherently risky due to price volatility, weather unpredictability, and low levels of farmer collateral, which futures markets could mitigate—but only if banks step in to provide initial liquidity.

3. Global Price Discovery and Local Marginalization#

The dominance of global commodity futures markets exacerbates this issue:

African producers effectively import price volatility from these global markets without the ability to hedge locally.

Local futures markets could enable farmers and traders to lock in prices and manage risk, but banks’ reluctance to provide liquidity perpetuates their dependence on global markets.

Export-dominant crops like coffee and cocoa are priced in international currencies, which further limits the utility of local futures markets unless paired with robust currency risk management tools.

4. Regulatory Blind Spots and Lack of Policy Push#

Governments often lack the vision or capacity to incentivize banks to channel funds into more productive sectors like agriculture or local futures markets.

Regulations favoring treasuries over agricultural or market-focused investments deepen the problem.

Policy inertia and a focus on short-term fiscal goals discourage governments from reimagining financial systems to align with long-term developmental needs.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

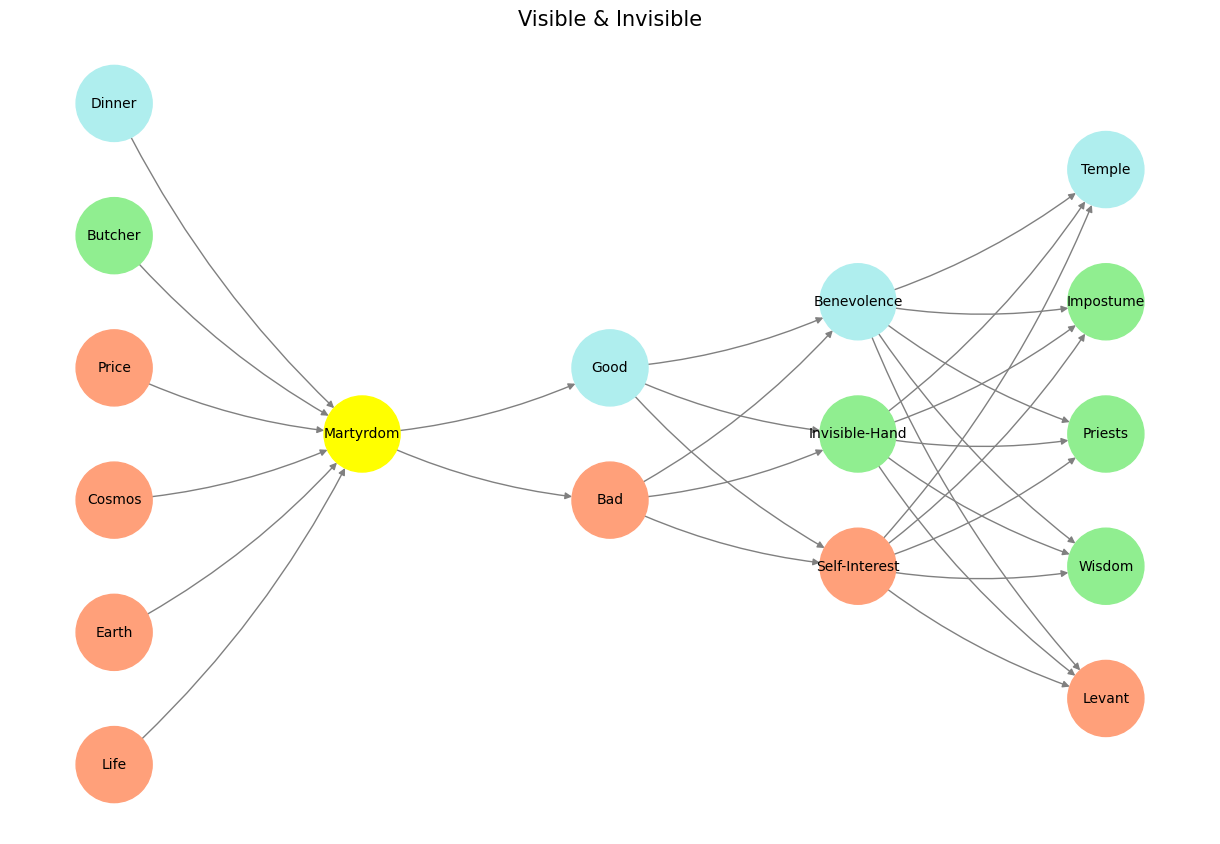

# Define the neural network structure; modified to align with "Aprés Moi, Le Déluge" (i.e. Je suis AlexNet)

def define_layers():

return {

'Pre-Input/CudAlexnet': ['Life', 'Earth', 'Cosmos', 'Price', 'Butcher', 'Dinner'],

'Yellowstone/SensoryAI': ['Martyrdom'],

'Input/AgenticAI': ['Bad', 'Good'],

'Hidden/GenerativeAI': ['Self-Interest', 'Invisible-Hand', 'Benevolence'],

'Output/PhysicalAI': ['Levant', 'Wisdom', 'Priests', 'Impostume', 'Temple']

}

# Assign colors to nodes

def assign_colors(node, layer):

if node == 'Martyrdom':

return 'yellow'

if layer == 'Pre-Input/CudAlexnet' and node in [ 'Dinner']:

return 'paleturquoise'

if layer == 'Pre-Input/CudAlexnet' and node in [ 'Butcher']:

return 'lightgreen'

elif layer == 'Input/AgenticAI' and node == 'Good':

return 'paleturquoise'

elif layer == 'Hidden/GenerativeAI':

if node == 'Benevolence':

return 'paleturquoise'

elif node == 'Invisible-Hand':

return 'lightgreen'

elif node == 'Self-Interest':

return 'lightsalmon'

elif layer == 'Output/PhysicalAI':

if node == 'Temple':

return 'paleturquoise'

elif node in ['Impostume', 'Priests', 'Wisdom']:

return 'lightgreen'

elif node == 'Levant':

return 'lightsalmon'

return 'lightsalmon' # Default color

# Calculate positions for nodes

def calculate_positions(layer, center_x, offset):

layer_size = len(layer)

start_y = -(layer_size - 1) / 2 # Center the layer vertically

return [(center_x + offset, start_y + i) for i in range(layer_size)]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

G = nx.DiGraph()

pos = {}

node_colors = []

center_x = 0 # Align nodes horizontally

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

y_positions = calculate_positions(nodes, center_x, offset=-len(layers) + i + 1)

for node, position in zip(nodes, y_positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(assign_colors(node, layer_name))

# Add edges (without weights)

for layer_pair in [

('Pre-Input/CudAlexnet', 'Yellowstone/SensoryAI'), ('Yellowstone/SensoryAI', 'Input/AgenticAI'), ('Input/AgenticAI', 'Hidden/GenerativeAI'), ('Hidden/GenerativeAI', 'Output/PhysicalAI')

]:

source_layer, target_layer = layer_pair

for source in layers[source_layer]:

for target in layers[target_layer]:

G.add_edge(source, target)

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=10, connectionstyle="arc3,rad=0.1"

)

plt.title("Visible & Invisible", fontsize=15)

plt.show()

# Run the visualization

visualize_nn()

Fig. 14 The Dance of Compliance (Firmness With Our Ideals). Ultimately, compliance need not be a chain but a dance—an interplay of soundness, tactfulness, and firm commitment. By embracing a neural network-inspired redesign, institutions can elevate online training from a grudging obligation to an empowering journey. Like Bach’s grounding, Mozart’s tactfulness, and Beethoven’s transformative vision, the new model harmonizes the past, present, and future, ensuring that institutions remain firmly committed to their values and ideals while adapting to the ever-evolving world.#