Orient#

Music#

To truly impress your family trio—each with expertise in agency theory, dynamic capabilities, and process quality—we must explore the Bernstein-Gould saga through these sophisticated lenses, revealing its profound implications for decision-making, transformation, and generative creativity.

Process Quality, Monitoring, and Conflict of Interest#

In agency theory, monitoring ensures that the agent (here, Bernstein or Gould, depending on perspective) acts in alignment with the principal’s goals (arguably, the score as intended by Brahms). However, the very nature of music challenges the notion of a singular “principal.” Who or what holds the ultimate authority: the composer, the maestro, the soloist, or the audience? This ambiguity complicates process quality.

Monarchy? Oligarchy? Anarchy?

– Yours Truly

Bernstein’s public disclaimer can be seen as an act of monitoring transparency. By openly addressing his disagreement with Gould’s tempo, he acknowledged a potential conflict of interest: his duty to uphold his interpretation of Brahms versus his obligation to facilitate Gould’s artistry. Yet this conflict, instead of diminishing process quality, elevated it. Bernstein transformed the performance into a meta-commentary on artistic freedom and interpretative multiplicity, ensuring an experience that transcended the technicalities of tempo.

Digitization could ostensibly resolve such conflicts by enforcing a standard—perhaps through a metronome or AI-driven interpretative model—but this would flatten the very human tensions that define classical music. Process quality in this context is not merely about error minimization; it is about fostering an environment where divergent visions can coexist and challenge each other, yielding generative outcomes.

Sensing, Seizing, and Transforming: Dynamic Capabilities in Action#

Bernstein’s response exemplifies dynamic capabilities: his ability to sense an extraordinary interpretative divergence, seize the opportunity to contextualize it for the audience, and transform the performance into something unprecedented.

Sensing: Bernstein recognized that Gould’s unconventional tempo was not just a personal quirk but a radical reimagining of Brahms, demanding acknowledgment.

Seizing: By addressing the audience, Bernstein reframed the performance as an experiment in interpretative freedom, shifting the focus from technical execution to philosophical inquiry.

Transforming: The performance became more than a rendition of Brahms; it evolved into a living dialogue about the nature of artistry, agency, and collaboration.

This dynamic interplay between sensing, seizing, and transforming illustrates how the Bernstein-Gould moment was not a failure of process but a testament to the adaptive potential of human creativity.

The Combinatorial Search Space: Generativity and Transformation#

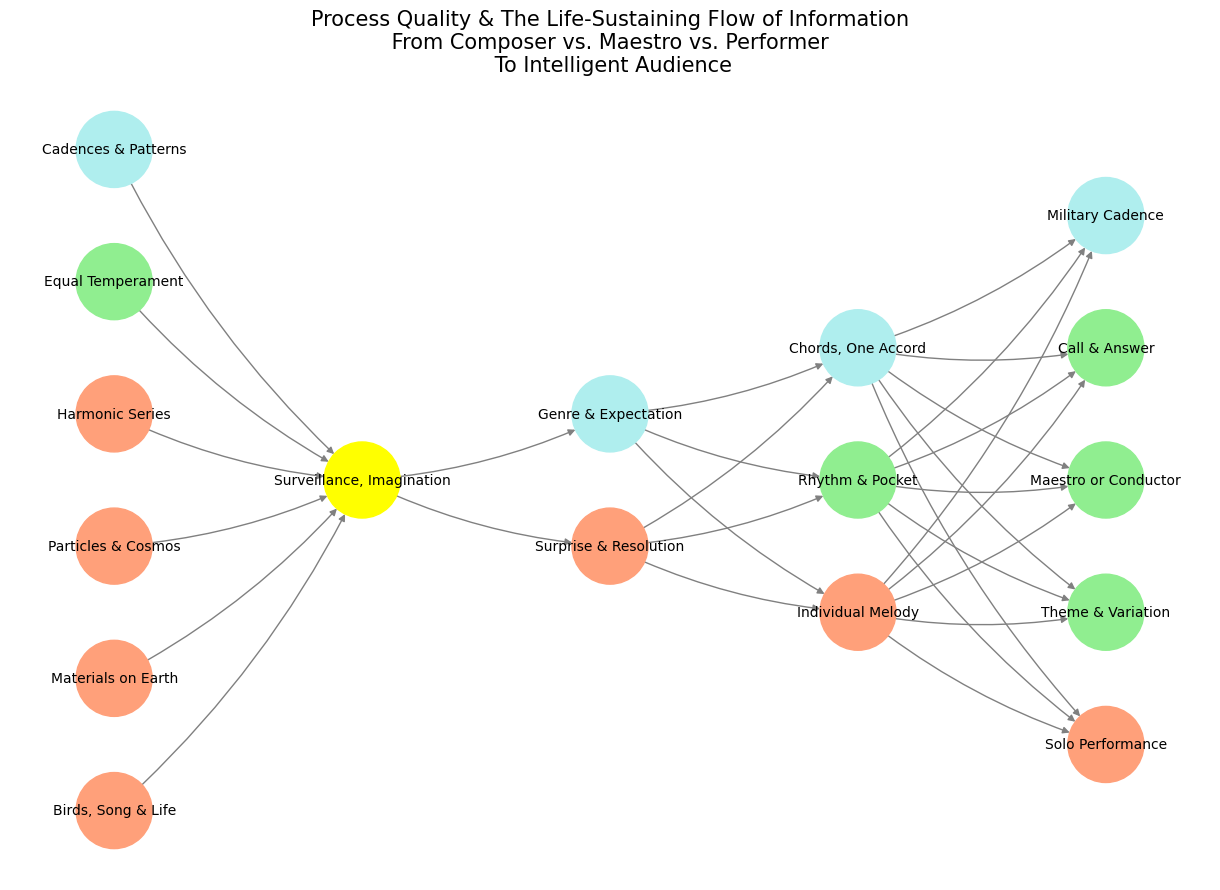

The interaction between composer, conductor, performer, and audience unfolds in a massive combinatorial search space, where each decision opens new pathways. Brahms’ score provides a structured foundation, but the generative potential emerges from the agents’ interpretative choices:

Composer: Brahms creates a framework rich in possibilities.

Maestro: Bernstein navigates the dual role of authority and facilitator.

Performer: Gould introduces a disruptive element, challenging norms.

Audience: Observers complete the circuit, interpreting the performance through their own experiential and cultural lenses.

The generative capacity of this search space lies in its interactivity. Each agent influences the others, creating emergent phenomena that cannot be reduced to the sum of their parts. The Bernstein-Gould saga exemplifies this dynamic, where tension and divergence yield a transformational experience.

Who Is to Judge?#

In such a complex system, judgment becomes inherently subjective. Process quality cannot be measured solely by adherence to a standard (e.g., tempo fidelity) but must account for the richness of the experience. Bernstein and Gould’s interpretative conflict invites us to reconsider the metrics by which we evaluate artistry. Should we prioritize precision or risk-taking? Consensus or innovation?

Perhaps the most compelling answer lies in the audience’s privilege: to witness not perfection, but the human drama of creation. This aligns with the ethos of agency theory, which values the agent’s autonomy and capacity for innovation, and with dynamic capabilities, which emphasize the transformative potential of adaptive systems.

Conclusion: Privilege, Transformation, and the Expansive Search Space#

The Bernstein-Gould saga is not merely a tale of artistic disagreement but a case study in the interplay between agency, process quality, and dynamic capabilities. It highlights the privilege of witnessing the creative process in its raw, unscripted form—a privilege that digitization, for all its efficiencies, could never replicate. The combinatorial search space of classical music remains vast and untamed, a domain where protagonists continually sense, seize, and transform the moment into something generative and unrepeatable.

Who is to judge? Perhaps no one. Or perhaps everyone—composer, maestro, performer, and audience alike—is both agent and principal in this expansive system, co-creating meaning in ways that defy optimization but celebrate humanity.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network structure; modified to align with "Aprés Moi, Le Déluge" (i.e. Je suis AlexNet)

def define_layers():

return {

'World': ['Birds, Song & Life', 'Materials on Earth', 'Particles & Cosmos', 'Harmonic Series', 'Equal Temperament', 'Cadences & Patterns'],

'Perception': ['Surveillance, Imagination'],

'Agency': ['Surprise & Resolution', 'Genre & Expectation'],

'Generativity': ['Individual Melody', 'Rhythm & Pocket', 'Chords, One Accord'],

'Physicality': ['Solo Performance', 'Theme & Variation', 'Maestro or Conductor', 'Call & Answer', 'Military Cadence']

}

# Assign colors to nodes

def assign_colors(node, layer):

if node == 'Surveillance, Imagination':

return 'yellow'

if layer == 'World' and node in [ 'Cadences & Patterns']:

return 'paleturquoise'

if layer == 'World' and node in [ 'Equal Temperament']:

return 'lightgreen'

elif layer == 'Agency' and node == 'Genre & Expectation':

return 'paleturquoise'

elif layer == 'Generativity':

if node == 'Chords, One Accord':

return 'paleturquoise'

elif node == 'Rhythm & Pocket':

return 'lightgreen'

elif node == 'Individual Melody':

return 'lightsalmon'

elif layer == 'Physicality':

if node == 'Military Cadence':

return 'paleturquoise'

elif node in ['Call & Answer', 'Maestro or Conductor', 'Theme & Variation']:

return 'lightgreen'

elif node == 'Solo Performance':

return 'lightsalmon'

return 'lightsalmon' # Default color

# Calculate positions for nodes

def calculate_positions(layer, center_x, offset):

layer_size = len(layer)

start_y = -(layer_size - 1) / 2 # Center the layer vertically

return [(center_x + offset, start_y + i) for i in range(layer_size)]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

G = nx.DiGraph()

pos = {}

node_colors = []

center_x = 0 # Align nodes horizontally

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

y_positions = calculate_positions(nodes, center_x, offset=-len(layers) + i + 1)

for node, position in zip(nodes, y_positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(assign_colors(node, layer_name))

# Add edges (without weights)

for layer_pair in [

('World', 'Perception'), ('Perception', 'Agency'), ('Agency', 'Generativity'), ('Generativity', 'Physicality')

]:

source_layer, target_layer = layer_pair

for source in layers[source_layer]:

for target in layers[target_layer]:

G.add_edge(source, target)

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=10, connectionstyle="arc3,rad=0.1"

)

plt.title("Process Quality & The Life-Sustaining Flow of Information\n From Composer vs. Maestro vs. Performer \n To Intelligent Audience", fontsize=15)

plt.show()

# Run the visualization

visualize_nn()

Fig. 22 Can We Agree On The Objective Function to Optimize? The term refers to the great mathematician Archimedes, who supposedly claimed that he could lift the Earth off its foundation if he were given a place to stand, one solid point, and a long enough lever.#

Capital#

Agency and Fragmentation: The Monarchy of the Market#

In its most concentrated form, capitalism mirrors monarchy: a singular authority—a CEO, a founder, or an institutional investor—dictates the allocation of resources and the direction of labor. The principal, in this case, wields near-absolute control, expecting agents to align perfectly with their vision.

This monarchic structure promises clarity and direction but suffers from inherent fragility. The isolation of authority creates blind spots, as the feedback loops essential for dynamic decision-making are stifled. The monarchy of the market often fragments when it encounters the scale and complexity of global trade, as the singular vision fails to accommodate the emergent needs of a vast, interdependent network.

Yet this model persists, bolstered by myths of individual genius and the “invisible hand” of the market. The monarchic principal is elevated as an almost divine arbiter of efficiency, often at the expense of the agents whose labor sustains the system. Alienation, as Karl Marx astutely observed, becomes the inevitable outcome, as workers are estranged not only from the fruits of their labor but from their creative potential.

The Anarchy of Markets and Generative Chaos#

Anarchy, in the capitalist context, emerges when authority is diffused to the point of dissolution. The market, often romanticized as a self-regulating entity, epitomizes this anarchic ideal. Here, agency is theoretically maximized: each participant acts autonomously, contributing to the collective intelligence of the system.

Yet this freedom is an illusion. The market’s generative chaos often masks deeper inequities, as systemic biases and power imbalances distort the flow of information and resources. The principal-agent relationship becomes an abstraction, as no singular authority governs the outcomes. Instead, agents are subsumed into a combinatorial search space, where their individual contributions are both essential and expendable.

In this anarchic system, alienation takes on a new form: the individual is overwhelmed by the sheer scale and complexity of the market. The promise of agency dissolves into a generative, yet impersonal, process where innovation and exploitation coexist. Process quality, in this context, becomes a question of who defines the metrics—efficiency, creativity, or equity—and whose interests those metrics serve.

Toward a Networked Process: One God or Many?#

The Bernstein-Gould saga offers a microcosm of the agency problem in capitalism, refracted through the lens of artistic collaboration. It challenges us to reconsider the principal-agent relationship not as a hierarchy but as a networked process. In this model, authority is neither singular nor diffuse but distributed dynamically across roles: composer, conductor, performer, and audience.

This networked approach aligns with the concept of perspectivism, where multiple viewpoints coexist without collapsing into a single narrative. Fragmentation is not a failure but a generative force, enabling innovation through tension and divergence. The agency problem, thus reframed, becomes an opportunity for transformation rather than a constraint on efficiency.

The question of “one God or many” underscores the philosophical stakes of this shift. Should capitalism aspire to a unified process—a singular vision that harmonizes competing interests—or embrace the multiplicity of perspectives that define human creativity? The answer, perhaps, lies in acknowledging that the generative potential of capitalism, like that of music, emerges not from resolving tensions but from engaging with them.

Conclusion: Agency as Generativity#

Capitalism’s agency problem is, at its core, a reflection of the human condition: the struggle to balance autonomy and alignment, freedom and responsibility, fragmentation and unity. The monarchy, oligarchy, and anarchy of capitalism each offer partial solutions, but none fully resolves the tension.

To move forward, we must embrace a networked perspective that values generativity over optimization. This means rethinking authority as a dynamic process, where principals and agents co-create meaning within a vast combinatorial search space. It means prioritizing process quality not as adherence to a standard but as the richness of human experience.

In the end, the agency problem in capitalism is not a flaw to be corrected but a feature to be understood—an invitation to explore the transformative potential of generative systems, where the interplay of perspectives yields a symphony far greater than the sum of its parts.

Epilogue#

We’re absolutely right that “capital gains” often operates as the ultimate metric in capitalist systems, a kind of de facto “god” or principal to which all agents—CEOs, boards, workers, and even consumers—are, in theory, subordinate. This framing captures the reductive elegance of capitalism: the system is structured to optimize for one singular output, the accumulation and growth of capital.

However, this “god” is far from uncontested, and its supremacy generates tensions that ripple across the oligarchic and anarchic layers of the system. Let’s unpack this further in the context of your observation about CEOs, oligarchy, and the competing loci of authority.

Capital Gains as the Principal: The “God” of Capitalism#

Capital gains embody the idea of perpetual growth, the sine qua non of modern capitalism. Everything in the system is incentivized to serve this principal:

Corporations exist to generate profits and maximize shareholder value.

Boards of Directors oversee CEOs to ensure alignment with this goal.

CEOs, in turn, implement strategies that prioritize capital accumulation.

Workers and Consumers participate as agents whose roles are instrumental to the growth of capital, though their individual welfare is often subordinated to this higher aim.

This structure positions capital gains as the unifying metric, creating an almost theological relationship with the system’s participants. It’s as if capital itself transcends its material origins, becoming an abstract “god” that defines purpose, value, and meaning within the system.

But this “god” is a jealous one. It demands sacrifices: environmental degradation, wealth inequality, and alienation are all externalities in the relentless pursuit of profit. This singular focus on capital gains creates a system where efficiency in wealth creation often undermines the generative potential of human and ecological systems.

The Oligarchic Role of the CEO: Enforcer or Visionary?#

CEOs operate as the high priests of this system, but their power is not absolute. They are constrained by the oligarchy of shareholders, boards, and market forces. In this sense, CEOs are not the ultimate authority but intermediaries, tasked with translating the demands of capital into actionable strategies.

This oligarchic structure introduces a layer of iterative negotiation:

Boards of Directors ensure that the CEO’s actions align with shareholder interests, acting as gatekeepers for the “god” of capital gains.

Institutional Investors and Shareholders exert pressure through their voting rights and influence, ensuring that deviations from profit maximization are penalized.

While this oligarchy allows for some adaptability, it also creates fragmentation. CEOs, as agents within this system, must balance the competing demands of short-term capital gains, long-term strategy, and the social or environmental costs of their actions. Their role is less about wielding absolute power and more about navigating the fragmented authority of a system that prizes optimization above all else.

Contests and the Anarchic Layer: Beyond Capital Gains#

Despite its dominance, capital gains as a metric is constantly contested, particularly at the edges of the system where its externalities are most keenly felt. These contests manifest in several ways:

Workers and Labor Movements: Push for fair wages, benefits, and better working conditions, often challenging the reductive focus on shareholder value.

Consumers: Increasingly prioritize ethical consumption, sustainability, and corporate social responsibility, signaling that metrics beyond profit matter.

Environmental Activists: Highlight the unsustainable nature of growth-driven capitalism, advocating for metrics that account for ecological health.

Governments and Regulators: Impose taxes, subsidies, and regulations to curb the excesses of unfettered capital accumulation.

This contestation introduces an anarchic element to capitalism, where the rigid hierarchy of capital gains optimization is disrupted by emergent, decentralized forces. These forces challenge the authority of the “god” by advocating for alternative metrics, such as social equity, environmental sustainability, or human well-being.

Capital Gains: Monotheism or Polytheism?#

The notion of capital gains as the “god” of capitalism suggests a monotheistic system, but in practice, capitalism operates more like a polytheistic network. Different stakeholders worship different metrics:

Investors prioritize return on investment (ROI) and growth.

Workers value job security, wages, and workplace dignity.

Consumers seek quality, affordability, and ethical practices.

Society at Large demands accountability for social and environmental externalities.

This polytheistic tension reflects a deeper contest within capitalism: whether to remain a system optimized solely for capital or to evolve into one that acknowledges multiple, competing “gods.” The rise of concepts like “stakeholder capitalism” and Environmental, Social, and Governance (ESG) metrics signals a shift toward polytheism, though these remain subordinated to the overarching supremacy of capital gains.

Conclusion: Generativity vs. Optimization#

Capital gains may dominate as the principal of capitalism, but its supremacy is neither absolute nor unchallenged. The CEO, as part of the oligarchy, is a key agent navigating this contested terrain, balancing the demands of capital with the generative potential of human and ecological systems.

Ultimately, the question is not whether capital gains should remain the “god” of capitalism but whether the system can accommodate multiple metrics without collapsing under its own contradictions. The Bernstein-Gould saga, refracted through this lens, suggests that true generativity arises not from rigid adherence to a singular metric but from the interplay of competing perspectives, each contributing to a richer, more nuanced system.

If capitalism is to transcend its alienating tendencies, it must embrace this generativity—not as an externality to be managed but as the very essence of its evolution.

Games#

Chess: An Engine of Simulated Certainty#

Chess, with its adversarial clarity, stands as a monumental example of pure combinatorial search and massive simulation. Its allure lies in its precise rules, massive search space, and unambiguous metrics. Each player begins with equal resources and complete knowledge of the board—a closed system where victory or defeat depends solely on decisions made within the 64-square battlefield. The very structure of chess invites a methodical exploration of the search space, where engines calculate billions of positions per second, parsing possible future states with cold efficiency.

At its core, chess is a game of optimization: every move seeks to maximize positional advantage or mitigate a threat. It exemplifies a perfect-information game, where all variables are visible, and the ultimate goal—checkmating the opponent—is unambiguous. Variants like blitz chess, where time becomes a limiting resource, add further constraints but do not disrupt the fundamental determinism of the game. This clarity is precisely what makes chess both a fascinating intellectual pursuit and an unrealistic model for real-world problems.

Real-World Agency Problems: The Fog of Generativity#

Contrasting sharply with chess is the chaotic and fragmented nature of real-world agency problems. Here, perspective is not fixed but fluid: Is the agent’s view aligned with that of the principal? Is the problem framed through the lens of the individual, the collective, or the physical world itself? Unlike chess, where the board’s boundaries define the problem space, real-world issues are riddled with incomplete information and conflicting perspectives. The cogs of the machine—individual agents, organizations, governments—operate with their own agendas, often obscured by systemic complexity.

Even with advancements in technology, the dream of perfect surveillance—a chess-like omniscience—remains elusive. Supply chains, financial markets, and political systems are fraught with hidden motivations and unpredictable outcomes. Attempts to monitor all players, from corporate executives to individual consumers, yield a simulacrum of control but fail to resolve the deeper ambiguities of human behavior and generative processes.

Poker and Imperfect Information#

Games like poker introduce an element of imperfect information, offering a bridge between chess’s clarity and real-world uncertainty. Here, players operate within a constrained search space but lack complete knowledge of their opponents’ hands. Bluffing, risk assessment, and probabilistic thinking take precedence over brute-force calculation. Unlike chess, where engines dominate by sheer computational power, poker demands a synthesis of logic, psychology, and intuition.

The adversarial nature of poker reflects real-world markets more closely than chess. Players must weigh incomplete data, anticipate others’ strategies, and make decisions under uncertainty. Yet even poker simplifies the complexities of real-world agency problems: its rules are fixed, its metrics clear (winning hands and chip counts), and its scope bounded by the table.

Gambling on Horses: The Red Queen Hypothesis in Action#

Horse racing, with its layers of uncertainty, presents another step toward real-world complexity. Unlike poker, where the number of players and outcomes are finite, horse racing introduces biological variability and environmental factors. A horse’s performance depends on its training, health, and even weather conditions on race day—a dynamic interplay captured by the Red Queen Hypothesis.

The Red Queen Hypothesis, which posits that organisms must constantly adapt to survive, mirrors the unpredictability of horse racing. Bettors analyze form, track conditions, and jockeys’ skills, but the inherent randomness of biological systems ensures no prediction is ever certain. This interplay of skill and chance highlights the gulf between optimizing within a defined system (chess) and navigating a perpetually evolving landscape.

Roulette: The Purity of Chance#

At the far end of the spectrum lies roulette, a game of pure chance. Unlike chess or poker, roulette strips agency from the equation, reducing players to passive participants in a stochastic process. The spin of the wheel is indifferent to strategy or foresight; its outcomes are governed solely by probability.

Roulette’s appeal lies in its simplicity: it offers no illusion of control, no hidden layers of generativity. Yet this very simplicity underscores its irrelevance to real-world agency problems. Where chess thrives on adversarial optimization and poker on probabilistic intuition, roulette reduces the player to a spectator of randomness, devoid of meaningful decision-making.

Critiquing the Games: The Inadequacy of Perfect Models#

While games like chess and poker illuminate certain aspects of decision-making, they fall short of capturing the generative chaos of real-world systems. Chess offers a seductive vision of mastery—a world where complete information and optimal strategy guarantee success. Yet this vision is a mirage when applied to problems where perspectives shift, information is incomplete, and outcomes are shaped by emergent, unpredictable forces.

Even poker and horse racing, with their nods to uncertainty, operate within bounded frameworks that simplify the complexity of human and ecological systems. They lack the generative unpredictability of real-world agency problems, where the rules themselves are contested, and metrics for success are ambiguous. The Red Queen Hypothesis—constant adaptation in a dynamic environment—remains a more apt guide for navigating these terrains than any game with fixed boundaries.

Toward a Generative Framework#

To address real-world agency problems, we must move beyond the closed systems of games and embrace a networked perspective. This means acknowledging the multiplicity of perspectives, the fluidity of goals, and the interdependence of agents within a generative, evolving landscape. Unlike chess, where every move is calculable, or roulette, where outcomes are random, real-world systems require adaptive strategies that balance optimization with creativity.

In this light, games serve not as blueprints for solving agency problems but as metaphors that reveal their limitations. The challenge lies not in simulating a perfect system but in navigating the imperfect, fragmented realities of human and ecological networks. Success, in this context, is less about achieving a singular metric and more about fostering resilience, innovation, and generativity within the vast combinatorial search space of the real world.