Ecosystem#

Agent banking, while a critical innovation in financial inclusion, operates within a precarious liquidity structure that can make it an attractive target for adversaries. The nature of agency banking ensures that significant cash reserves are held by agents who facilitate transactions for individuals and businesses unable to access traditional banking channels. This liquidity, however, can become both an asset and a liability, as it increases operational exposure to risks such as robbery, fraud, and insolvency.

Liquidity in agency banking arises from the necessity of maintaining a steady cash flow to meet customer demands. Unlike traditional banking institutions that rely on electronic transactions and vault security, agent banking depends on physical cash movement. This means that agents must constantly balance cash availability with security measures to prevent financial disruptions. The paradox here is that an agent’s success—measured by their ability to facilitate large transactions—also makes them a conspicuous target for criminals. The moment an agent becomes known for handling high-value transactions, their risk profile shifts from being a financial facilitator to a high-stakes liquidity hub susceptible to attacks.

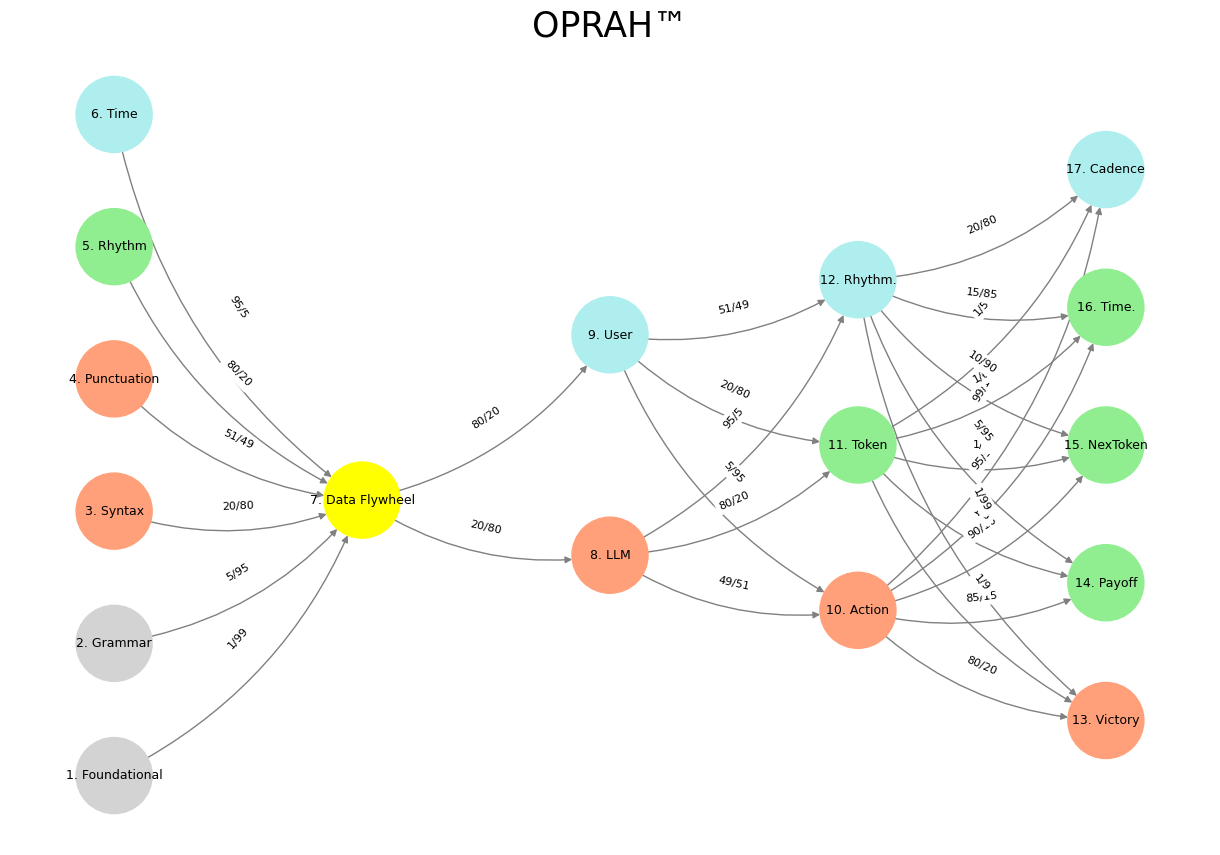

Fig. 7 Deviens: To Deviate From the Group & Become One’s Own. Indeed, deviens (from the French verb devenir, “to become”) and deviating share a common Latin root: venire, meaning “to come.” Etymological Breakdown: 1. Devenir (deviens, 2nd-person singular present tense) From Latin devenire (“to come down, arrive at”), composed of: de- (“down, away, from”)venire (“to come”) 2. Deviate From Latin deviāre (“to turn aside, wander”), composed of: de- (“away, off”) via (“way, path”). Shared Concept: Both words imply movement away from a prior state or direction: Deviens (devenir) → Becoming something different, emerging as one’s own. Deviate (dévier) → Straying from an expected path, diverging from the group. Thematic Connection: This suggests that becoming (devenir) contains an implicit divergence from the collective, an individuation. To become oneself may require a deviation from predefined paths—so the journey of devenir might inherently include dévier at key junctures.#

Your interpretation that agent bankers must maintain a minimum liquidity threshold in line with transaction limits is broadly correct. If an agent is handling transactions that exceed the individual transaction caps imposed by mobile money services, they must have access to capital reserves to facilitate those transactions. In this context, if a mobile money service imposes a transaction limit of $20 million per individual, then agents must hold liquidity at that level or beyond to meet potential demand. This creates a clear visibility issue: the very function of agency banking—serving those who need higher transaction capacities—establishes a known minimum liquidity that can be exploited by criminals.

The case of a cash-in-transit robbery illustrates how agency banking liquidity is not merely a financial concept but a physical and operational risk. Unlike digital banking institutions that can mitigate risks through electronic security and fraud detection systems, agency bankers operate in an environment where cash remains the dominant form of value exchange. Robbers are acutely aware of this vulnerability. The knowledge that agent bankers must maintain high liquidity levels makes them ideal targets for coordinated attacks. This problem is exacerbated when the capital used to sustain liquidity is borrowed, as in the case of mortgaging property for an overdraft facility. The loss of cash in such a scenario does not merely reflect an operational setback but triggers a cascading financial crisis that can lead to insolvency.

Moreover, liquidity in agency banking is not just about cash availability—it extends to the ability to recover from financial shocks. When an agent suffers a significant financial loss, the structural constraints of the business model make recovery exceedingly difficult. Unlike traditional banks that can rely on broader financial instruments such as insurance, digital fraud detection, and diversified revenue streams, agency banking operates on thin margins. The ability to maintain cash flow is tied directly to continued business operations, meaning that any major disruption—such as a robbery—can permanently impair an agent’s ability to function.

The broader implication is that agency banking, while an essential component of financial inclusion, must reassess its liquidity models to ensure sustainability. Increased regulatory oversight, improved security measures, and alternative liquidity management strategies are necessary to mitigate risks. If agent bankers are expected to handle high-value transactions, then the financial system must provide corresponding protections, such as better insurance policies, secure transport logistics, and diversified financial tools to reduce dependence on physical cash movement.

In conclusion, agency banking’s liquidity structure is both its strength and its Achilles’ heel. The very nature of handling large cash volumes makes agents lucrative targets for criminals, and any financial loss—especially one incurred through violent means—can spiral into long-term financial ruin. This exposes a fundamental flaw in the current model: high liquidity should not equate to high vulnerability. Without stronger risk management frameworks, agency banking will continue to be an attractive token to adversaries, where liquidity translates to exposure rather than financial empowerment.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network layers

def define_layers():

return {

'Suis': ['Foundational', 'Grammar', 'Syntax', 'Punctuation', "Rhythm", 'Time'], # Static

'Voir': ['Data Flywheel'],

'Choisis': ['LLM', 'User'],

'Deviens': ['Action', 'Token', 'Rhythm.'],

"M'èléve": ['Victory', 'Payoff', 'NexToken', 'Time.', 'Cadence']

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Data Flywheel'],

'paleturquoise': ['Time', 'User', 'Rhythm.', 'Cadence'],

'lightgreen': ["Rhythm", 'Token', 'Payoff', 'Time.', 'NexToken'],

'lightsalmon': ['Syntax', 'Punctuation', 'LLM', 'Action', 'Victory'],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Define edge weights (hardcoded for editing)

def define_edges():

return {

('Foundational', 'Data Flywheel'): '1/99',

('Grammar', 'Data Flywheel'): '5/95',

('Syntax', 'Data Flywheel'): '20/80',

('Punctuation', 'Data Flywheel'): '51/49',

("Rhythm", 'Data Flywheel'): '80/20',

('Time', 'Data Flywheel'): '95/5',

('Data Flywheel', 'LLM'): '20/80',

('Data Flywheel', 'User'): '80/20',

('LLM', 'Action'): '49/51',

('LLM', 'Token'): '80/20',

('LLM', 'Rhythm.'): '95/5',

('User', 'Action'): '5/95',

('User', 'Token'): '20/80',

('User', 'Rhythm.'): '51/49',

('Action', 'Victory'): '80/20',

('Action', 'Payoff'): '85/15',

('Action', 'NexToken'): '90/10',

('Action', 'Time.'): '95/5',

('Action', 'Cadence'): '99/1',

('Token', 'Victory'): '1/9',

('Token', 'Payoff'): '1/8',

('Token', 'NexToken'): '1/7',

('Token', 'Time.'): '1/6',

('Token', 'Cadence'): '1/5',

('Rhythm.', 'Victory'): '1/99',

('Rhythm.', 'Payoff'): '5/95',

('Rhythm.', 'NexToken'): '10/90',

('Rhythm.', 'Time.'): '15/85',

('Rhythm.', 'Cadence'): '20/80'

}

# Calculate positions for nodes

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

colors = assign_colors()

edges = define_edges()

G = nx.DiGraph()

pos = {}

node_colors = []

# Create mapping from original node names to numbered labels

mapping = {}

counter = 1

for layer in layers.values():

for node in layer:

mapping[node] = f"{counter}. {node}"

counter += 1

# Add nodes with new numbered labels and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

new_node = mapping[node]

G.add_node(new_node, layer=layer_name)

pos[new_node] = position

node_colors.append(colors.get(node, 'lightgray'))

# Add edges with updated node labels

for (source, target), weight in edges.items():

if source in mapping and target in mapping:

new_source = mapping[source]

new_target = mapping[target]

G.add_edge(new_source, new_target, weight=weight)

# Draw the graph

plt.figure(figsize=(12, 8))

edges_labels = {(u, v): d["weight"] for u, v, d in G.edges(data=True)}

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=9, connectionstyle="arc3,rad=0.2"

)

nx.draw_networkx_edge_labels(G, pos, edge_labels=edges_labels, font_size=8)

plt.title("OPRAH™", fontsize=25)

plt.show()

# Run the visualization

visualize_nn()

Fig. 8 For the eyes of the Lord run to and fro throughout the whole earth, to shew himself strong in the behalf of them whose heart is perfect toward him. Herein thou hast done foolishly: therefore from henceforth thou shalt have wars. Source: 2 Chronicles 16: 8-9. The grammar of these visuals is plain: there’s a space & time for the cooperative rhythm, transactional, and adversarial.#