Base#

Blockchain and cryptocurrency represent a profound leap in the evolution of transactional systems by embodying principles of parallel processing and time-compression. Unlike traditional banking systems, which operate on centralized architectures with inherent delays due to operational bottlenecks, blockchain harnesses decentralized networks to process transactions simultaneously across nodes. This paradigm shift eliminates the temporal inefficiencies that plague conventional financial systems, particularly the delays introduced by weekends, public holidays, and interbank settlement protocols.

In traditional banking, clearing and settlement involve a sequential series of approvals, reconciliations, and validations across multiple intermediaries. This linearity not only prolongs transaction times but also introduces vulnerabilities to human error and systemic failures. For instance, cross-border payments often take three to five business days due to currency conversion, compliance checks, and varying operational hours across jurisdictions. These delays are compounded by rigid banking hours and institutional downtime during holidays, creating artificial barriers to seamless economic activity.

Fig. 25 The Next Time Your Horse is Behaving Well, Sell it. The numbers in private equity don’t add up because its very much like a betting in a horse race. Too many entrants and exits for anyone to have a reliable dataset with which to estimate odds for any horse-jokey vs. the others for quinella, trifecta, superfecta#

Blockchain disrupts this paradigm by enabling transactions to be verified and settled in near real-time, regardless of geographic or temporal constraints. Its decentralized architecture allows multiple nodes to validate and record transactions concurrently, functioning as a distributed ledger that compresses time and operational complexity. The absence of intermediaries eliminates the need for sequential approvals, as consensus algorithms (like proof of work or proof of stake) ensure the integrity of transactions in parallel. This capability transforms time from a limiting factor into an optimized dimension, where the value exchange is nearly instantaneous.

Cryptocurrencies, as applications of blockchain, exemplify this time-compression. Consider Bitcoin or Ethereum, where transactions are settled in minutes rather than days. These networks operate continuously, unaffected by the artificial constraints of banking hours or holidays. The perpetual uptime of blockchain networks mirrors the ethos of a global, interconnected economy that transcends the limitations of localized banking systems. Time, in this context, is not a resource to be hoarded or rationed but a dynamic element optimized for efficiency.

From a systems perspective, blockchain’s time-compression parallels the principles of parallel processing in computing. Just as modern processors divide computational tasks across multiple cores to execute them simultaneously, blockchain divides transactional validation across its network. Each node in the blockchain performs computations to validate transactions independently yet in coordination with the entire network. This decentralized redundancy ensures resilience while accelerating throughput. The result is a system that not only handles transactions faster but also scales efficiently as more participants join the network.

Moreover, the implications of this time-compression extend beyond convenience. Blockchain’s capacity to settle transactions in real-time unlocks new economic opportunities, enabling high-frequency trading, instantaneous remittances, and seamless microtransactions. It democratizes access to financial systems, empowering individuals in remote or underbanked regions to participate in the global economy without the delays and barriers imposed by traditional institutions.

In essence, blockchain and cryptocurrency are technological embodiments of temporal liberation. They transform time from a passive dimension into an active enabler of economic activity. By aligning financial processes with the speed and efficiency of modern computing, blockchain compresses the inefficiencies of traditional systems into obsolescence, heralding an era where value can move as swiftly as thought. This synthesis of parallel processing and time-compression not only redefines the mechanics of finance but also reimagines the very fabric of economic interaction.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network fractal

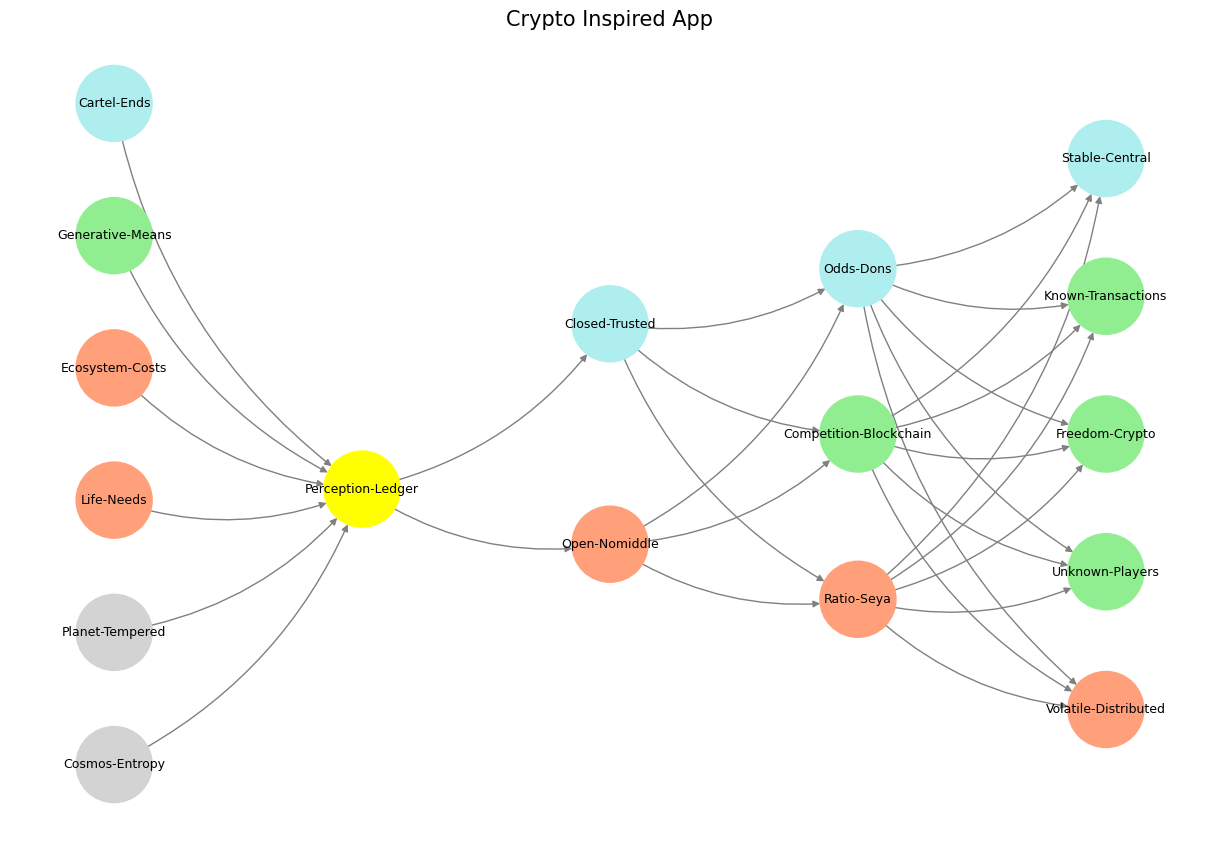

def define_layers():

return {

'World': ['Cosmos-Entropy', 'Planet-Tempered', 'Life-Needs', 'Ecosystem-Costs', 'Generative-Means', 'Cartel-Ends', ], ## Cosmos, Planet

'Perception': ['Perception-Ledger'], # Life

'Agency': ['Open-Nomiddle', 'Closed-Trusted'], # Ecosystem (Beyond Principal-Agent-Other)

'Generative': ['Ratio-Seya', 'Competition-Blockchain', 'Odds-Dons'], # Generative

'Physical': ['Volatile-Distributed', 'Unknown-Players', 'Freedom-Crypto', 'Known-Transactions', 'Stable-Central'] # Physical

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Perception-Ledger'],

'paleturquoise': ['Cartel-Ends', 'Closed-Trusted', 'Odds-Dons', 'Stable-Central'],

'lightgreen': ['Generative-Means', 'Competition-Blockchain', 'Known-Transactions', 'Freedom-Crypto', 'Unknown-Players'],

'lightsalmon': [

'Life-Needs', 'Ecosystem-Costs', 'Open-Nomiddle', # Ecosystem = Red Queen = Prometheus = Sacrifice

'Ratio-Seya', 'Volatile-Distributed'

],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Calculate positions for nodes

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

colors = assign_colors()

G = nx.DiGraph()

pos = {}

node_colors = []

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(colors.get(node, 'lightgray')) # Default color fallback

# Add edges (automated for consecutive layers)

layer_names = list(layers.keys())

for i in range(len(layer_names) - 1):

source_layer, target_layer = layer_names[i], layer_names[i + 1]

for source in layers[source_layer]:

for target in layers[target_layer]:

G.add_edge(source, target)

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=9, connectionstyle="arc3,rad=0.2"

)

plt.title("Crypto Inspired App", fontsize=15)

plt.show()

# Run the visualization

visualize_nn()

#

Fig. 26 From a Pianist View. Left hand voices the mode and defines harmony. Right hand voice leads freely extend and alter modal landscapes. In R&B that typically manifests as 9ths, 11ths, 13ths. Passing chords and leading notes are often chromatic in the genre. Music is evocative because it transmits information that traverses through a primeval pattern-recognizing architecture that demands a classification of what you confront as the sort for feeding & breeding or fight & flight. It’s thus a very high-risk, high-error business if successful. We may engage in pattern recognition in literature too: concluding by inspection but erroneously that his silent companion was engaged in mental composition he reflected on the pleasures derived from literature of instruction rather than of amusement as he himself had applied to the works of William Shakespeare more than once for the solution of difficult problems in imaginary or real life. Source: Ulysses#