Catalysts#

Physics Envy and the Illusion of Immutable Order

The phrase “Physics Envy” captures an undeniable phenomenon in modern economics and finance: the fetishization of physical laws as a framework for understanding everything from markets to human behavior. Economists, enamored by the simplicity, clarity, and immutable elegance of equations governing the physical universe, have long sought to imbue their own discipline with a similar sense of certainty. In doing so, they’ve drafted physicists—literal physicists—into their ranks, particularly in banking and finance, under the pretense that the cosmos, life, and society are merely extensions of the same fundamental principles. This belief has spawned an entire era of probabilistic modeling and pattern recognition, where the games of the financial elite resemble the roll of dice or the spin of a roulette wheel far more than the nuanced complexity of human agency.

Thinking about what I want to do with my life.. a spark in my life

– Ayesha Ofori

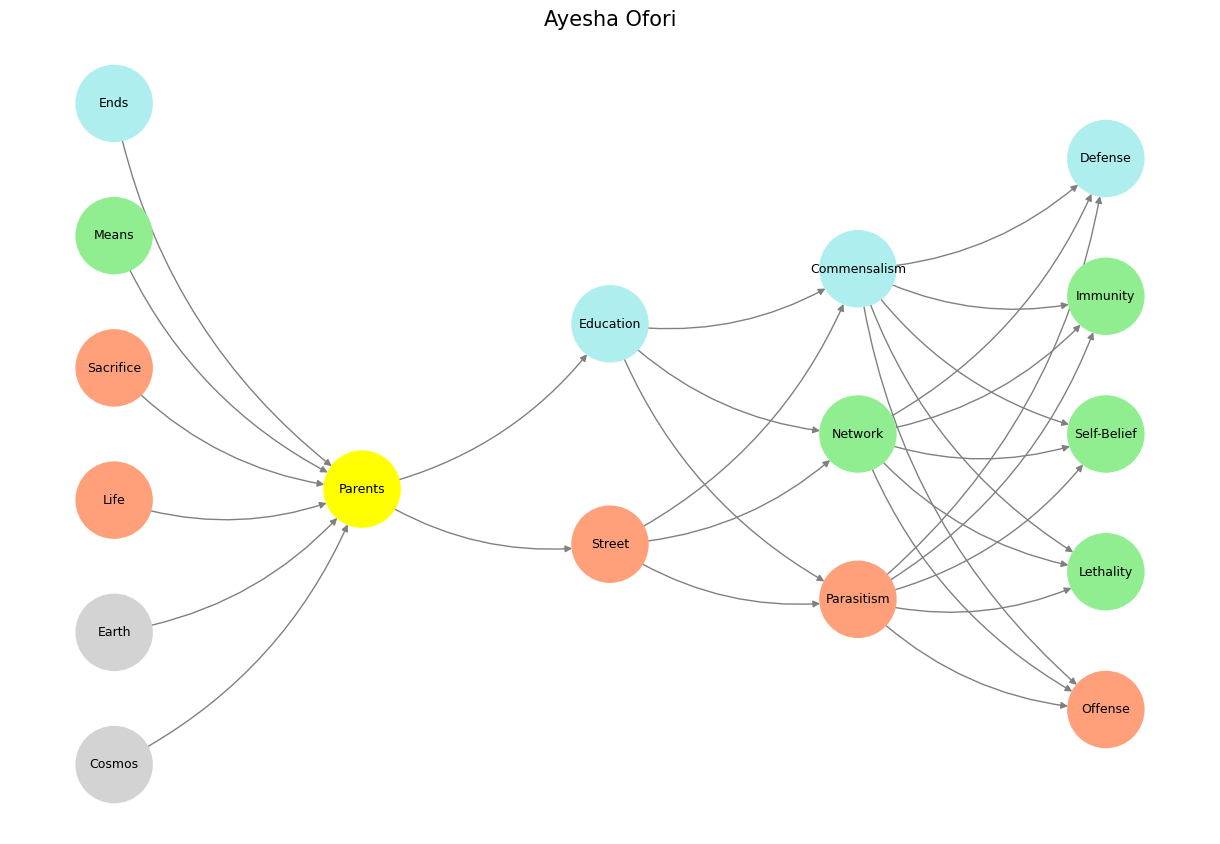

Fig. 6 TEICH: Teach Them How - African English Women. All history is about trial, error, iteration, compression, heritage – or a pervasion of this “tried & tested” truth from the streets (Prov 1:20) Great story that uncovers the simple truth: trial-and-error is the mechanism of learning. Those who stand on shoulders of civilizations, heritage, and giants, are often denied this simple Dionysian truth. Instead, they inherit an Apollonian compunction about history. It’s a fault.#

Immutable Games and the Seduction of Elegance#

There is undeniable beauty in the immutable calculus of games that hinge entirely on chance. Roulette, dice, and coin tosses, for instance, are pure manifestations of probabilistic determinism. The outcome is governed by mathematical laws that, once understood, offer no room for skill, no place for intervention. Even poker, despite its human elements, has been reduced by physicist-modelers to probabilities and expected values, stripping it of its soul and human drama. In such games, humanity itself is irrelevant; the immutable calculus reigns supreme.

This clarity has led economists to adopt a “casino logic” in their analysis of markets. Market behavior, in this worldview, is reduced to rational expectations, efficient outcomes, and risk measured with cold precision. It is no wonder that financial institutions have likened themselves to guardians of a cosmos governed by physical laws, elevating themselves to quasi-gods of a deterministic universe. For them, the future can be calculated, hedged, and insured against, with no room for the messy unpredictability of human error or innovation.

Marginal Games: Pattern Recognition and False Certainty#

Yet, the games of the world tell a different story—one of ambiguity, skill, and speculation. Consider games like Mahjong, Backgammon, or Go, where pattern recognition, intuition, and strategy play significant roles, but luck cannot be entirely discounted. These games embody a tension between human agency and randomness. The dice rolls of Backgammon, for instance, introduce an element of chaos that even the most skilled player must contend with. Mahjong players navigate probabilities embedded in the tiles, balancing calculation with gut instinct. Pai Gow Poker, with its blend of chance and pattern-based decision-making, offers another such example.

What separates these games from pure chance is the whisper of control they offer—an illusion, perhaps, but a compelling one. Skill can improve one’s odds, but only slightly, and often inconsistently. They exist in a liminal space, teasing the human mind into believing it has agency in a fundamentally uncertain world. It is this tantalizing illusion that economists and financiers seek to harness, turning markets into their own marginal gameboards, where the “players” are governed by models of bounded rationality, marginal gains, and iterative equilibria.

The Tyranny of Misleading Patterns#

But this era of thinking is a dangerous one. The human brain, a product of millennia of evolution, is wired to detect patterns where none exist. This “high-risk, high-error” inheritance from our ancestors was a survival mechanism, helping early humans avoid predators by interpreting rustling leaves as danger. Today, these instincts persist in environments where they no longer serve us. In a big city like London or New York, the rustling leaves have been replaced by stock market fluctuations, yet the same primitive instincts drive our responses.

This is the great fallacy of Physics Envy: the belief that patterns are not only real but actionable in all contexts. The financial crises of the past decades stand as stark reminders of this delusion. The models—rooted in elegant equations and backed by armies of physicists—failed spectacularly when confronted with the messy, unpredictable reality of human behavior. Markets, like Mahjong tiles, may hint at patterns, but their true nature is one of inherent chaos, shaped by a million unquantifiable variables.

Leaves in the Wind: The Future of Recognition#

If there is a lesson to be learned from this era, it is that pattern recognition, while a powerful tool, is not infallible. The shushing of leaves once meant survival; now, it is a relic of a past that no longer exists. Economists and financiers must learn to distinguish between the immutable laws of physics and the mutable, often chaotic nature of human society. The dice may roll, the cards may fall, but human agency—and its capacity for innovation, error, and unpredictability—will always disrupt even the most elegant equations.

In the end, the pursuit of immutable order in an inherently mutable world is not only futile but dangerous. Physics Envy has led us astray, seducing us with the illusion of certainty while blinding us to the beauty—and the risk—of the unpredictable. It is time to move beyond this era, to embrace a new understanding of economics and society that respects the patterns but never forgets the chaos. After all, the greatest games are not those governed by immutable rules but those where skill and chance collide, creating a space where anything is possible.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network structure

def define_layers():

return {

'World': ['Cosmos', 'Earth', 'Life', 'Sacrifice', 'Means', 'Ends', ],

'Perception': ['Parents'],

'Agency': ['Street', 'Education'],

'Generativity': ['Parasitism', 'Network', 'Commensalism'],

'Physicality': ['Offense', 'Lethality', 'Self-Belief', 'Immunity', 'Defense']

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Parents'],

'paleturquoise': ['Ends', 'Education', 'Commensalism', 'Defense'],

'lightgreen': ['Means', 'Network', 'Immunity', 'Self-Belief', 'Lethality'],

'lightsalmon': [

'Life', 'Sacrifice', 'Street',

'Parasitism', 'Offense'

],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Calculate positions for nodes

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

colors = assign_colors()

G = nx.DiGraph()

pos = {}

node_colors = []

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(colors.get(node, 'lightgray')) # Default color fallback

# Add edges (automated for consecutive layers)

layer_names = list(layers.keys())

for i in range(len(layer_names) - 1):

source_layer, target_layer = layer_names[i], layer_names[i + 1]

for source in layers[source_layer]:

for target in layers[target_layer]:

G.add_edge(source, target)

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=9, connectionstyle="arc3,rad=0.2"

)

plt.title("Ayesha Ofori", fontsize=15)

plt.show()

# Run the visualization

visualize_nn()

Fig. 7 Inheritance, World View, Decisions, Exposure, Launchpad. The layers of the neural network might be given these names in one of its variants. Would capture the essence of Ayesha Ofori’s backpropagation and narrative and virtually everything a neural network stands for - Steve Jobs said you only connect the dots retrospectively. It is a truth universarlly acknowledged that parents have vastly more “data” than their fledgling infants. A child should listen to their parents. Of course some children have been raised by the streets following literal and metaphorical orphanhood.#