Ecosystem#

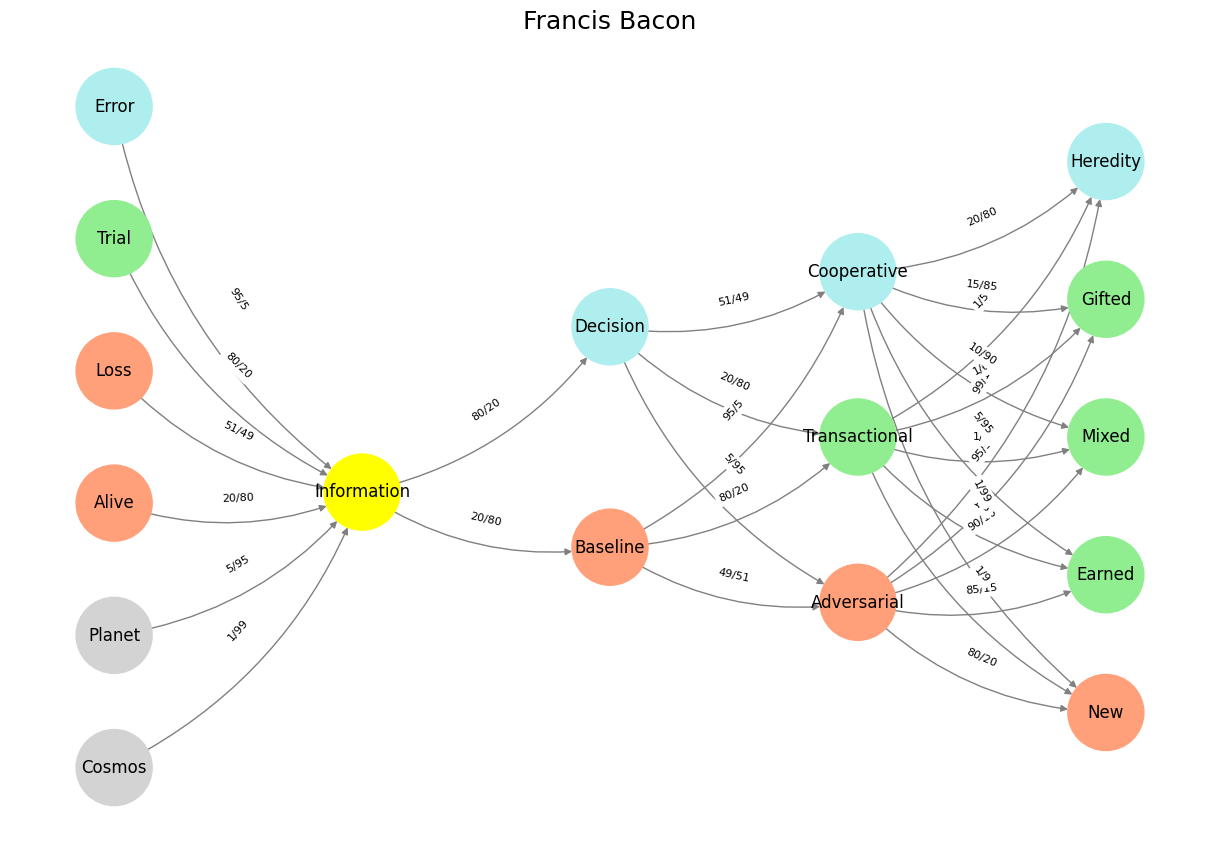

Conservative podcast hosts consistently advertise gold as an investment because their worldview is structurally predisposed toward adversarial equilibria, which frame financial security in terms of loss aversion and zero-sum conflict. In the neural network you’ve outlined, the connection between Loss and Information is a nearly even split (51/49), meaning that for conservative audiences, financial knowledge is intrinsically linked to fear of losing wealth. This fear is further amplified by the strong weight (95/5) between Error and Information, suggesting that within this network, information is overwhelmingly processed through past failures rather than potential gains. Thus, conservative audiences are primed to see the financial system as a rigged game where catastrophe is inevitable, making gold—an asset perceived as immune to government manipulation—an attractive hedge.

Fig. 6 Deviens: To Deviate From the Group & Become One’s Own. Indeed, deviens (from the French verb devenir, “to become”) and deviating share a common Latin root: venire, meaning “to come.” Etymological Breakdown: 1. Devenir (deviens, 2nd-person singular present tense) From Latin devenire (“to come down, arrive at”), composed of: de- (“down, away, from”)venire (“to come”) 2. Deviate From Latin deviāre (“to turn aside, wander”), composed of: de- (“away, off”) via (“way, path”). Shared Concept: Both words imply movement away from a prior state or direction: Deviens (devenir) → Becoming something different, emerging as one’s own. Deviate (dévier) → Straying from an expected path, diverging from the group. Thematic Connection: This suggests that becoming (devenir) contains an implicit divergence from the collective, an individuation. To become oneself may require a deviation from predefined paths—so the journey of devenir might inherently include dévier at key junctures.#

The role of Adversarial decision-making further cements this preference for gold. The network maps Baseline (a default state of knowledge) overwhelmingly to Adversarial (49/51), meaning that economic survival is understood primarily through conflict. When a podcast host introduces a financial decision point (Decision), the probability of an adversarial interpretation is only 5/95, indicating that active financial choices tend to reinforce pre-existing views of economic struggle rather than invite new perspectives. This makes gold ideal for messaging—it does not require iteration or transactional adjustments. Unlike stocks, which fluctuate based on complex cooperative market forces, gold is presented as a static safeguard against an encroaching adversarial world.

The weight distributions in Deviens (the layer encoding economic strategy) further reveal why gold fits conservative financial messaging so seamlessly. The link between Adversarial and Heredity is 99/1, meaning that wealth preservation is framed almost exclusively in terms of inheritance, dynastic continuity, and resistance to systemic change. Gold, as a non-productive but enduring asset, aligns perfectly with this belief system—it is not an investment in an evolving, cooperative economy but a defensive mechanism against that very evolution. This contrasts sharply with the Cooperative pathway, where Heredity is linked only 20/80, meaning cooperative financial strategies prioritize earned wealth over static preservation. In short, conservative messaging does not just sell gold—it sells an entire adversarial epistemology where financial survival is a battle against decay, inflation, and state control.

The transactional pathway, by contrast, is barely weighted toward wealth accumulation. The links between Transactional and New (1/9), Earned (1/8), Mixed (1/7), Gifted (1/6), and Heredity (1/5) suggest a gradual and negotiable process of financial growth through participation in markets. This is anathema to conservative financial messaging, which thrives on immediacy and certainty. Transactional thinking introduces the possibility that markets can function rationally, that value is not just preserved but created through investment, and that financial decisions are iterative rather than preordained. Gold advertisements bypass this entire process by presenting wealth as something already under siege—something that must be protected, not generated. The weak weighting of Cooperative toward Earned (5/95) further ensures that alternative narratives of economic engagement remain inaccessible.

The final reinforcement comes from M’éléve, the layer describing how financial strategies map onto personal status. The dominant weightings for Adversarial investments show that wealth in this framework is overwhelmingly associated with Heredity (99/1), Gifted (95/5), Mixed (90/10), and Earned (85/15). This means that in conservative financial ideology, even earned wealth is primarily interpreted as a function of adversarial struggle rather than organic participation in economic systems. The higher link between Cooperative and Mixed (10/90) suggests that those who favor cooperation are more comfortable with diversified financial portfolios rather than singular hedges. This is why conservative financial advice remains so fixated on gold: it eliminates ambiguity, compresses fear into a tangible asset, and aligns perfectly with an adversarial worldview that sees financial security as an unchanging battle rather than an evolving system.

In sum, conservative podcast hosts advertise gold not just because it is a profitable sponsorship opportunity but because their entire epistemology primes their audience to see the economy as a hostile force, where wealth is not created but defended. Gold is the perfect product for this mindset—static, adversarial, and resistant to cooperative revaluation. It is not just an investment in this framework; it is a talisman against the chaos of an economic system perceived as permanently rigged.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network layers

def define_layers():

return {

'Suis': ['Cosmos', 'Planet', 'Alive', 'Loss', "Trial", 'Error'], # Static

'Voir': ['Information'],

'Choisis': ['Baseline', 'Decision'],

'Deviens': ['Adversarial', 'Transactional', 'Cooperative'],

"M'èléve": ['New', 'Earned', 'Mixed', 'Gifted', 'Heredity']

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Information'],

'paleturquoise': ['Error', 'Decision', 'Cooperative', 'Heredity'],

'lightgreen': ["Trial", 'Transactional', 'Earned', 'Gifted', 'Mixed'],

'lightsalmon': ['Alive', 'Loss', 'Baseline', 'Adversarial', 'New'],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Define edge weights (hardcoded for editing)

def define_edges():

return {

('Cosmos', 'Information'): '1/99',

('Planet', 'Information'): '5/95',

('Alive', 'Information'): '20/80',

('Loss', 'Information'): '51/49',

("Trial", 'Information'): '80/20',

('Error', 'Information'): '95/5',

('Information', 'Baseline'): '20/80',

('Information', 'Decision'): '80/20',

('Baseline', 'Adversarial'): '49/51',

('Baseline', 'Transactional'): '80/20',

('Baseline', 'Cooperative'): '95/5',

('Decision', 'Adversarial'): '5/95',

('Decision', 'Transactional'): '20/80',

('Decision', 'Cooperative'): '51/49',

('Adversarial', 'New'): '80/20',

('Adversarial', 'Earned'): '85/15',

('Adversarial', 'Mixed'): '90/10',

('Adversarial', 'Gifted'): '95/5',

('Adversarial', 'Heredity'): '99/1',

('Transactional', 'New'): '1/9',

('Transactional', 'Earned'): '1/8',

('Transactional', 'Mixed'): '1/7',

('Transactional', 'Gifted'): '1/6',

('Transactional', 'Heredity'): '1/5',

('Cooperative', 'New'): '1/99',

('Cooperative', 'Earned'): '5/95',

('Cooperative', 'Mixed'): '10/90',

('Cooperative', 'Gifted'): '15/85',

('Cooperative', 'Heredity'): '20/80'

}

# Calculate positions for nodes

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

colors = assign_colors()

edges = define_edges()

G = nx.DiGraph()

pos = {}

node_colors = []

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(colors.get(node, 'lightgray'))

# Add edges with weights

for (source, target), weight in edges.items():

if source in G.nodes and target in G.nodes:

G.add_edge(source, target, weight=weight)

# Draw the graph

plt.figure(figsize=(12, 8))

edges_labels = {(u, v): d["weight"] for u, v, d in G.edges(data=True)}

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=12, connectionstyle="arc3,rad=0.2"

)

nx.draw_networkx_edge_labels(G, pos, edge_labels=edges_labels, font_size=8)

plt.title("Francis Bacon", fontsize=18)

plt.show()

# Run the visualization

visualize_nn()

Fig. 7 So we have a banking cartel, private ledgers, balancing payments, network of banks, and satisfied customer. The usurper is a public infrastructure, with open ledgers, digital trails, block-chain network, and liberated customer. Were not the Ethiopians and the Lubims a huge host, with very many chariots and horsemen? yet, because thou didst rely on the Lord, he delivered them into thine hand. For the eyes of the Lord run to and fro throughout the whole earth, to shew himself strong in the behalf of them whose heart is perfect toward him. Herein thou hast done foolishly: therefore from henceforth thou shalt have wars. Source: 2 Chronicles 16: 8-9#