Ecosystem#

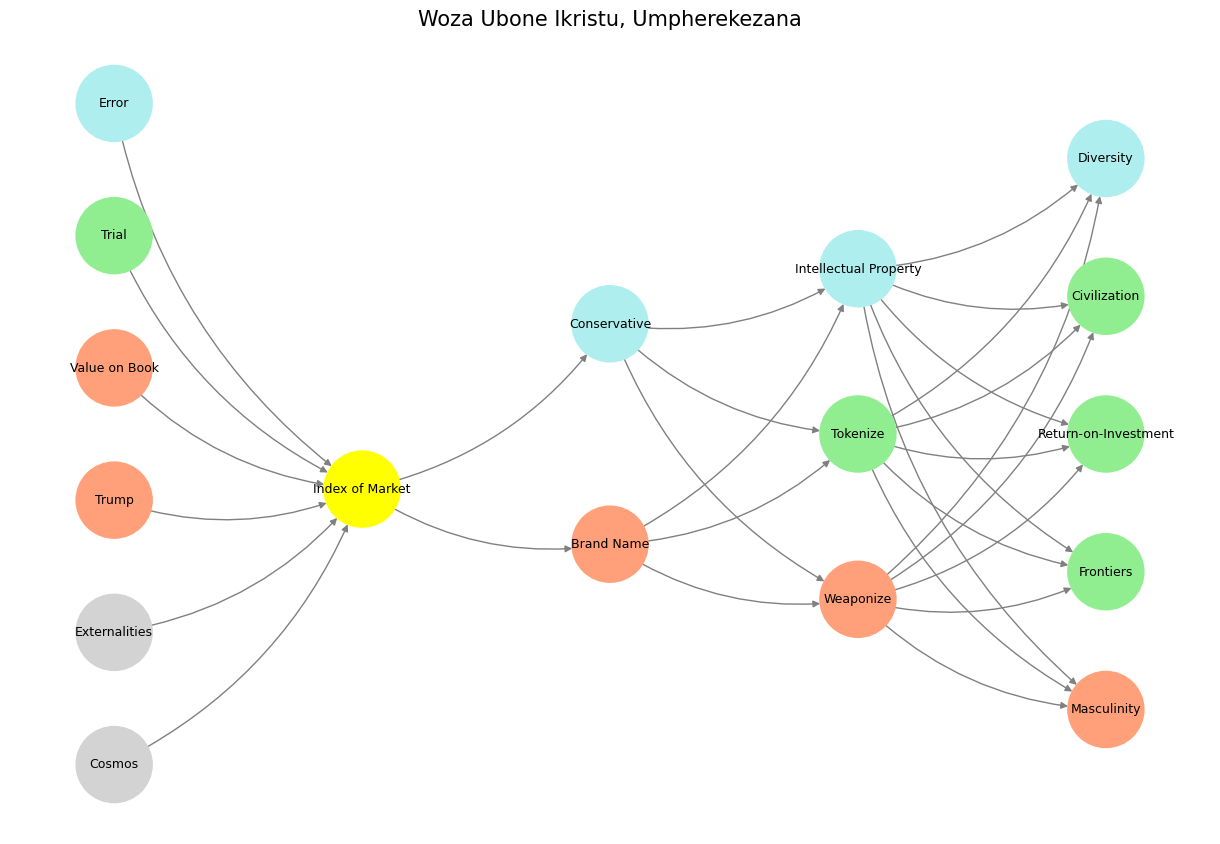

Eugene Fama’s model of efficient markets has long been a cornerstone of financial theory, but its limitations become glaring when placed within a broader framework of decision-making and valuation. Fama’s focus was primarily on the first, second, and fifth layers of decision-making—what can be likened to games of chance, poker, and long-term return on investment. These are significant, but they ignore two crucial layers: the razor’s edge of competitive branding and the strategic adversarial dynamics of monopolization, tokenization, and weaponization. By neglecting these elements, Fama’s framework captures only a fraction of how modern markets function. More crucially, when this model is transposed into other domains—clinical research, technological innovation, or even the broader philosophy of knowledge acquisition—it becomes evident that these missing layers hold the key to a fuller, more precise understanding of risk, valuation, and optimization.

Fig. 6 It Takes AI to Curate Data to Train AI. Isaiah 2:2-4 is the best quoted & also misunderstood article on the conditions of social harmony. Putnams discomforts with the data tells us that he was surprised by what the UN knew half a century earlier and what our biblical prophet articulated several millenia ago. Putnam published his data set from this study in 2001 and subsequently published the full paper in 2007. Putnam has been criticized for the lag between his initial study and his publication of his article. In 2006, Putnam was quoted in the Financial Times as saying he had delayed publishing the article until he could “develop proposals to compensate for the negative effects of diversity” (quote from John Lloyd of Financial Times). In 2007, writing in City Journal, John Leo questioned whether this suppression of publication was ethical behavior for a scholar, noting that “Academics aren’t supposed to withhold negative data until they can suggest antidotes to their findings.” On the other hand, Putnam did release the data in 2001 and publicized this fact. Source: Wikipedia#

To understand the limitations of Fama’s model, consider its preoccupation with the first layer: games of chance, where the odds are fixed and known. This is the world of coin tosses, dice rolls, and roulette wheels—where risk is quantifiable and deeply embedded in actuarial logic. This is where traditional accounting thrives, where bean counters master balance sheets, and where the mathematical precision of probabilities dictates decisions with little room for ambiguity. This layer provides the stable bedrock of financial markets and allows for the development of quantitative models, but it is fundamentally constrained by its assumption that randomness is independent and immutable.

The second layer shifts from the purely probabilistic to the strategic, moving into the world of poker. Here, the game is not dictated by fixed odds but by incomplete information and behavioral cues. Players make decisions not just on the strength of their hand but on the nervous tics, microexpressions, and unconscious tells of their opponents. This layer is about reading the market, sensing the ebbs and flows of sentiment, and making probabilistic bets based on imperfect data. Fama incorporated this into his model by acknowledging that markets misprice assets, that traders misinterpret signals, and that some participants operate with more information than others. Yet, his framework ultimately dismissed the idea that these inefficiencies could be systematically exploited, holding instead that markets would correct themselves in the long run.

This brings us to the fifth layer—the long-term return on investment—where the bulk of financial theory, and indeed much of human decision-making, is ultimately focused. Investors, like most people making major life decisions, seek a long-term optimization strategy, a commitment to an outcome that is expected to bear fruit over years or decades. This is the layer where strategy converges toward an ideal equilibrium, where short-term volatility gives way to fundamental valuation. Fama’s efficient market hypothesis fundamentally assumes that, while markets may be noisy, they are ultimately rational, and in the long run, prices will reflect intrinsic value. Most investors operate with this belief, dedicating their portfolios to long-term gains despite the turbulence of daily fluctuations.

Yet, what is conspicuously absent in this framework are the third and fourth layers, which fundamentally alter the nature of competition and risk. The third layer introduces branding, the razor-thin edge of competitive differentiation that can turn otherwise equal entities into decisive winners. In financial markets, this is the space of reputation, the microsecond advantages of high-frequency trading, or the small technological refinements that turn an ordinary competitor into an industry leader. In sports, it is the difference between a good racehorse and a champion, between a Formula One car and a Lewis Hamilton-driven machine. The underlying technology may be comparable, but the introduction of a skilled agent—whether a driver, jockey, or brand manager—can make the difference between mediocrity and dominance. Intellectual property, proprietary algorithms, and unique human talent all belong to this domain, yet Fama’s model largely ignores them, treating all stocks as interchangeable commodities rather than unique entities with vastly different strategic positions.

The fourth layer, even more critically, is the domain of adversarial strategy—monopolization, tokenization, and weaponization. This is the layer of warfare, where corporations seek to dominate markets, governments regulate to prevent undue control, and technologies become battlegrounds for power struggles. In financial terms, it manifests in the structuring of markets to favor incumbents, in regulatory capture, and in the deliberate use of tokens—whether fiat currencies, corporate shares, or blockchain assets—to shift the balance of power. Even Fama’s own model acknowledges elements of this in discussions of large versus small stock performance, yet it fails to account for how these dynamics fundamentally reshape valuation beyond the constraints of simple pricing mechanisms.

The omission of these two layers is not merely a theoretical gap but a profound limitation that extends beyond finance into fields such as clinical research. The medical world operates with its own version of tokenization and monopolization, where procedures, treatments, and diagnostic frameworks are standardized into rigid protocols. A patient enters a clinical setting with a default condition, and medical intervention acts as a tokenized shift, ostensibly moving them toward a better outcome. However, this process is often governed by monopolized frameworks—certain drugs receive approval over others, certain data points are prioritized while others are ignored, and entire classes of medical intervention become entrenched as the gold standard, regardless of whether they remain optimal. Adverse outcomes arise not from negligence but from a systemic failure to integrate the full complexity of decision-making into clinical reasoning.

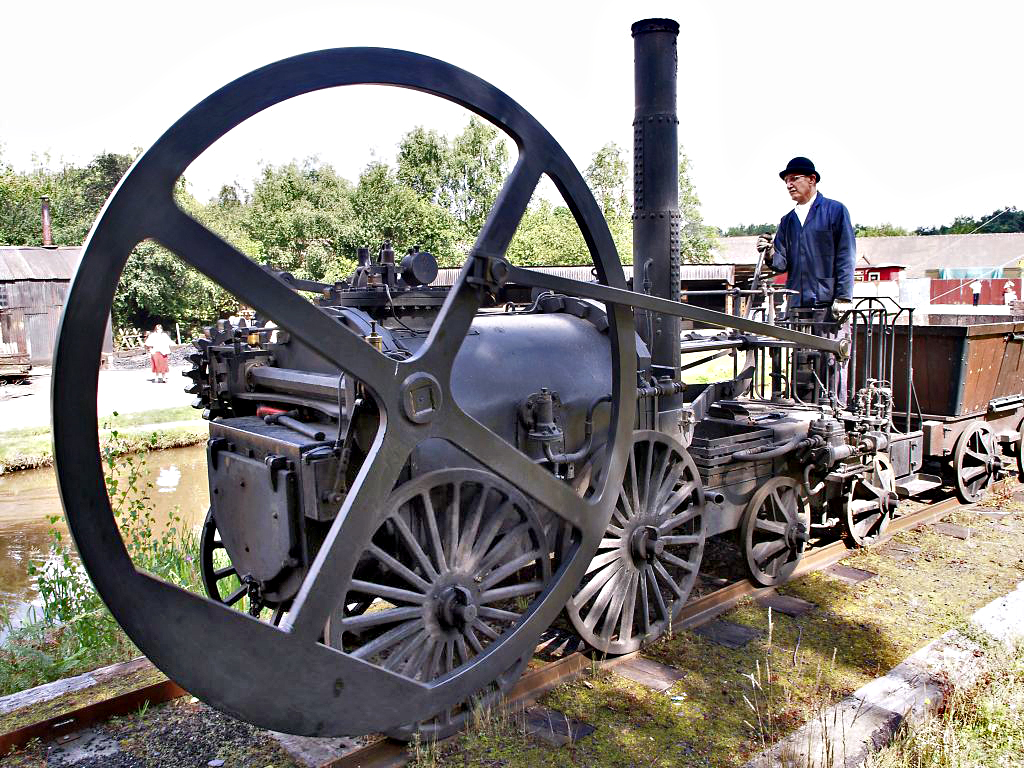

Fig. 7 Flywheel. CUDA is that thing already. From human programming (static software) to machine programming (dynamic landscape), ecosystem-cost of chips becomes more important than the quality of the chips. Holistic improvements rather than improvement of specific steps in the flywheel process are crucial. Combinatorial advantage (parallel-domain.specific transisters vs. serial-high performance from individual transister) Source: Wikipedia#

This is where the neural network fractal comes into play—a framework developed initially for clinical research but rapidly generalized into a model capable of digesting everything. The five-layer structure, recursively iterated in a veni, vidi, vici cycle, ensures that no single perspective dominates but that each phase of decision-making builds upon the last. The final vici of one iteration becomes the veni of the next, maintaining an unbroken chain of reevaluation and refinement. This fractal nature ensures that every decision—whether in finance, medicine, or any other domain—is assessed through an evolving process of observation, recognition, and strategic action.

At its core, this model captures a fundamental truth: value is not static but dynamic, shaped by the interplay of competition, perception, and power. Traditional models, like Fama’s, operate on a partial picture, privileging fixed odds, incomplete information, and long-term optimization while neglecting the razor-thin edge of competition and the adversarial dynamics of control. The Umpherekezana that emerges from this fractal neural network is not just a passive accompaniment but an active, adaptive process—one that continuously refines its understanding of reality, ensuring that no critical layer of decision-making is ignored.

The implications of this are profound. In finance, it means recognizing that brand equity, intellectual property, and competitive edge are just as vital to valuation as earnings reports and market sentiment. In medicine, it means acknowledging that clinical decisions are not merely about statistical risk but about the structural forces that shape what is considered treatable, measurable, and valuable. Across all domains, it demands an approach that is not merely reactive but perpetually reweighting, iterating, and refining—seeing beyond the surface, recognizing the unseen, and ultimately transforming the very nature of decision-making itself.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network fractal

def define_layers():

return {

'World': ['Cosmos', 'Externalities', "Trump", 'Value on Book', 'Trial', 'Error', ],

'Mode': ['Index of Market'],

'Agent': ['Brand Name', 'Conservative'],

'Space': ['Weaponize', 'Tokenize', 'Intellectual Property'],

'Time': ["Masculinity", 'Frontiers', 'Return-on-Investment', 'Civilization', 'Diversity']

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Index of Market'],

'paleturquoise': ['Error', 'Conservative', 'Intellectual Property', 'Diversity'],

'lightgreen': ['Trial', 'Tokenize', 'Frontiers', 'Return-on-Investment', 'Civilization'],

'lightsalmon': [

"Trump", 'Value on Book', 'Brand Name',

'Weaponize', "Masculinity"

],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Calculate positions for nodes

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

colors = assign_colors()

G = nx.DiGraph()

pos = {}

node_colors = []

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(colors.get(node, 'lightgray'))

# Add edges (automated for consecutive layers)

layer_names = list(layers.keys())

for i in range(len(layer_names) - 1):

source_layer, target_layer = layer_names[i], layer_names[i + 1]

for source in layers[source_layer]:

for target in layers[target_layer]:

G.add_edge(source, target)

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=9, connectionstyle="arc3,rad=0.2"

)

plt.title("Woza Ubone Ikristu, Umpherekezana", fontsize=15)

plt.show()

# Run the visualization

visualize_nn()

Fig. 8 So we have a banking cartel, private ledgers, balancing payments, network of banks, and satisfied customer. The usurper is a public infrastructure, with open ledgers, digital trails, block-chain network, and liberated customer. Were not the Ethiopians and the Lubims a huge host, with very many chariots and horsemen? yet, because thou didst rely on the Lord, he delivered them into thine hand. For the eyes of the Lord run to and fro throughout the whole earth, to shew himself strong in the behalf of them whose heart is perfect toward him. Herein thou hast done foolishly: therefore from henceforth thou shalt have wars. Source: 2 Chronicles 16: 8-9#