Failure#

The Art of the Lie: Sales Pitches, Compounding, and the Buffett-Munger Playbook

In the realm of finance, there exists an unspoken truth: much of the industry’s success hinges on bending the narrative just enough to make the money come in. Whether it’s a sales pitch dressed in the allure of guaranteed returns or the strategic optimism shared with investors, this “little bit of lying” has become an accepted norm. Once the money is secured, compounding—what Warren Buffett and Charlie Munger have famously described as the eighth wonder of the world—takes care of the rest.

At the heart of this strategy is the idea that narratives sell. A successful pitch isn’t just about numbers; it’s about belief. Whether you’re pitching a private equity deal, an index fund, or even the next big tech startup, the goal is to craft a story that resonates just enough to nudge investors off the sidelines. This isn’t outright deception; it’s selective emphasis. Highlighting the track record of success while conveniently downplaying the risks and uncertainties, sales teams create a narrative arc that aligns with what people want to hear—security, growth, and the promise of compounding returns.

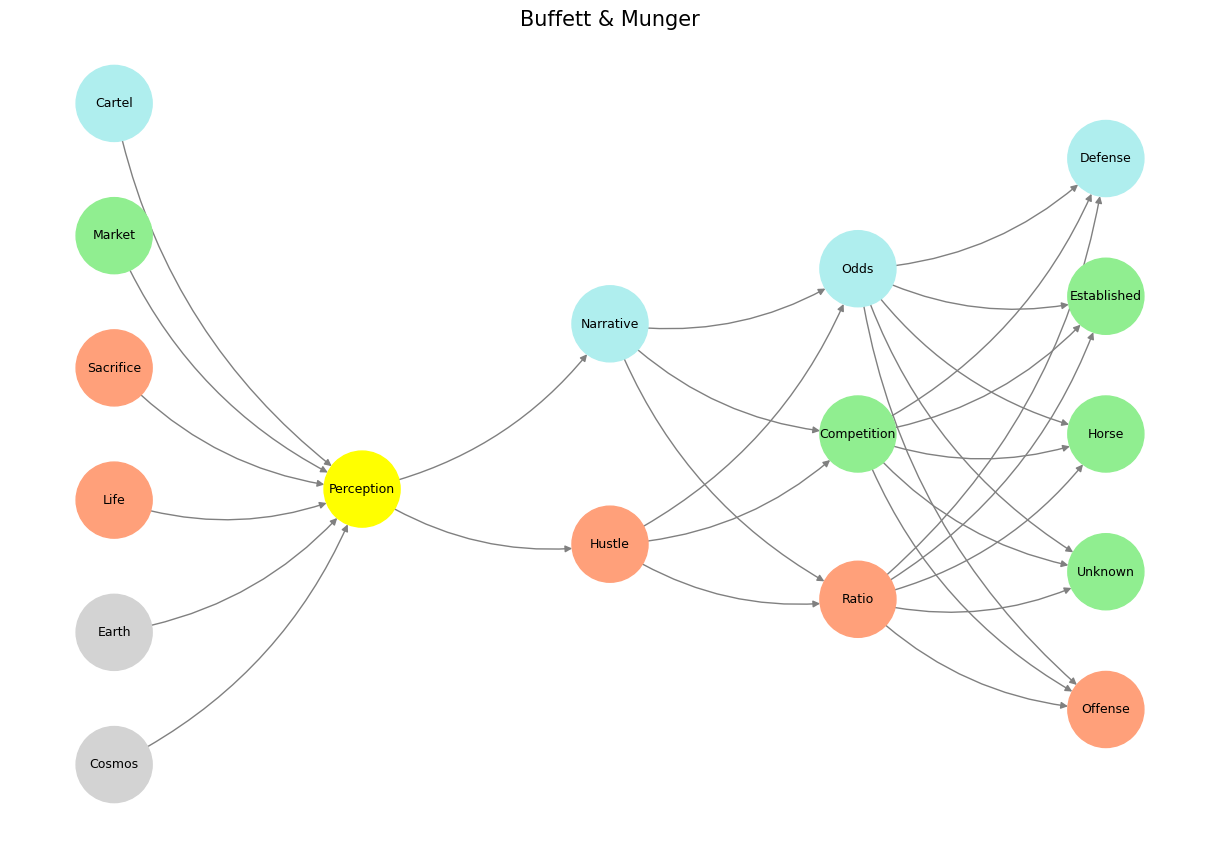

Fig. 22 The Next Time Your Horse is Behaving Well, Sell it. The numbers in private equity don’t add up because its very much like a betting in a horse race. Too many entrants and exits for anyone to have a reliable dataset with which to estimate odds for any horse-jokey vs. the others for quinella, trifecta, superfecta#

Once the money is in, the beauty of compounding takes over. Buffett and Munger have built an empire on this principle. Their strategy hinges on the idea that, over time, the consistent reinvestment of earnings will generate exponential growth. But here’s the kicker: compounding needs a starting point. For Berkshire Hathaway and its subsidiaries, that starting point is investor trust, built on the very narratives crafted in their annual letters and public commentary. Buffett’s homespun wisdom and Munger’s razor-sharp wit aren’t just entertaining; they’re strategic. These tools keep investors patient and engaged, allowing compounding to work its magic.

Bernie Bernheim is a horse of a different color, ethics-wise

– Miller’s Crossing

But is this “little bit of lying” ethical? Critics might argue that even a well-intentioned distortion erodes trust, creating a slippery slope toward more egregious misrepresentations. Yet, defenders of this approach might point out that in an industry awash with uncertainty, optimism and narrative control are necessary evils. After all, the markets are fueled as much by sentiment as by fundamentals. Without a compelling pitch, capital wouldn’t flow, and compounding wouldn’t get the chance to shine.

Buffett and Munger themselves have acknowledged the importance of perception in building and sustaining wealth. In their view, the goal isn’t to deceive but to inspire confidence in a long-term vision. By focusing on businesses with strong fundamentals and allowing compounding to do the heavy lifting, they’ve turned this strategy into an art form. Yet even they would likely concede that every pitch contains an element of selective truth-telling.

In the end, the balance lies in intent and execution. A sales pitch may indeed “lie a little” to make the money come in, but if the underlying investments are sound and the principles of compounding are allowed to play out, the ends might justify the means. Whether one sees this as pragmatism or a necessary moral compromise depends on their perspective—but it’s hard to argue with the results when compounding takes the reins.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

import networkx as nx

# Define the neural network structure

def define_layers():

return {

'World': ['Cosmos', 'Earth', 'Life', 'Sacrifice', 'Market', 'Cartel', ],

'Perception': ['Perception'],

'Agency': ['Hustle', 'Narrative'],

'Generativity': ['Ratio', 'Competition', 'Odds'],

'Physicality': ['Offense', 'Unknown', 'Horse', 'Established', 'Defense']

}

# Assign colors to nodes

def assign_colors():

color_map = {

'yellow': ['Perception'],

'paleturquoise': ['Cartel', 'Narrative', 'Odds', 'Defense'],

'lightgreen': ['Market', 'Competition', 'Established', 'Horse', 'Unknown'],

'lightsalmon': [

'Life', 'Sacrifice', 'Hustle',

'Ratio', 'Offense'

],

}

return {node: color for color, nodes in color_map.items() for node in nodes}

# Calculate positions for nodes

def calculate_positions(layer, x_offset):

y_positions = np.linspace(-len(layer) / 2, len(layer) / 2, len(layer))

return [(x_offset, y) for y in y_positions]

# Create and visualize the neural network graph

def visualize_nn():

layers = define_layers()

colors = assign_colors()

G = nx.DiGraph()

pos = {}

node_colors = []

# Add nodes and assign positions

for i, (layer_name, nodes) in enumerate(layers.items()):

positions = calculate_positions(nodes, x_offset=i * 2)

for node, position in zip(nodes, positions):

G.add_node(node, layer=layer_name)

pos[node] = position

node_colors.append(colors.get(node, 'lightgray')) # Default color fallback

# Add edges (automated for consecutive layers)

layer_names = list(layers.keys())

for i in range(len(layer_names) - 1):

source_layer, target_layer = layer_names[i], layer_names[i + 1]

for source in layers[source_layer]:

for target in layers[target_layer]:

G.add_edge(source, target)

# Draw the graph

plt.figure(figsize=(12, 8))

nx.draw(

G, pos, with_labels=True, node_color=node_colors, edge_color='gray',

node_size=3000, font_size=9, connectionstyle="arc3,rad=0.2"

)

plt.title("Buffett & Munger", fontsize=15)

plt.show()

# Run the visualization

visualize_nn()

Fig. 23 Vet Advised When to Sell Horse. Right after an outstanding performance. Because you want to control how its perceived, the narrative backstory, and how its future performance might be imputed. Otherwise, reality manifests with point and interval estimates. This is the subject matter of the opening dialogue in Miller’s Crossing.#